On May 28, 2024, the implementation date for the move to T+1 settlement for transactions in US cash equities, corporate debt, and unit investment trusts went into effect. In addition to this change in the settlement cycle, DTCC ITP Matching (US) LLC ("ITPM"), which operates CTM® and TradeSuite ID®, an affiliate of DTCC ITP LLC, will become a Central Matching Service Provider (CMSP) that must, under Exchange Act Rule 17Ad-27, establish, implement, maintain and enforce written policies and procedures reasonably designed to facilitate Straight Through Processing (STP).

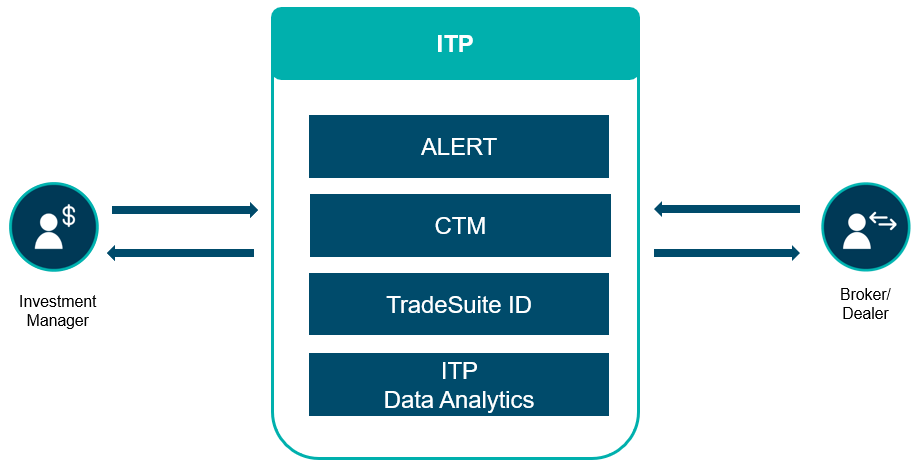

Refer below to a visual showing how ITP Services support the industry with a T+1 settlement cycle, as well as ITPM's Policies, Procedures and FAQ supporting its CMSP requirements.

ITP Services Overview

Please refer to the below resources to learn how ITP products support a T+1 settlement cycle.

The ALERT® platform is the industry’s largest and most compliant online global database for the maintenance and communication of account and standing settlement instructions (SSI), enabling a global community of investment managers, brokers/dealers, and custodian banks to share account and SSI data accurately and automatically. There are a number of features of ALERT which can be leveraged to facilitate a T+1 settlement cycle:

1. Enrichment of SSIs: this is the process by which standing settlement instructions (SSIs) and account information from the ALERT platform are added to trades sent for matching to the CTM service. To learn more about SSI Enrichment and the different ways that CTM users can enrich their trades, please refer to SSI Enrichment

2. ALERT Global Custodian Direct (GC Direct): this workflow automates the exchange of standing settlement instructions (SSIs) between a custodian's central repository and the ALERT host. This enhanced custodian/prime broker access enables the global custodian/prime broker to become the owner and maintainer of the SSI data, effectively creating the "golden copy" of SSI data within the ALERT platform.

Please visit ALERT Global Custodian Direct (GC Direct) to learn more about GCD.

CTM is a central matching platform used by both buy-side and sell-side clients to centrally match their cross-border and domestic transactions, automating the trade confirmation process across multiple asset classes, and facilitating downstream settlement processes. When using CTM in conjunction with ALERT, you can automatically enrich trades with account and standing settlement instructions (SSI), ensuring all account information is accurate.

Match to Instruct (M2i) is a workflow in CTM that automatically triggers trade affirmation and the delivery of DTC eligible securities directly to the DTC for settlement when a trade match occurs between an investment manager and executing broker. This workflow eliminates the need for either party to take further action and helps drive a significant increase in Same Day Affirmation (SDA) rates for DTC-eligible trades.

Please visit Match to Instruct (M2i) to learn more about M2i.

TradeSuite ID delivers efficiency and cost savings to firms through automated electronic trade agreement between counterparties. It helps streamline the post-trade process by electronically processing trade messages between all trading and settlement counterparties.

Affirmation Cutoff Changes – The table below describes the changes TradeSuite ID made to adhere to the timing changes for T+1. All times are stated in Eastern Time (ET).

|

Affirmation Type |

T+1 (Pre-May 28, 2024) |

T+1 (Effective May 28, 2024) |

|

Affirmation |

11:30am on S-1 |

9:00pm on S-1 |

|

Reverse Affirmation |

9:30am on S-1 |

9:00pm on S-1 |

|

Disaffirmation |

5:00pm on S-1 |

5:00pm on SD |

|

Late Affirmation (LMIT) |

11:30am on S-1 through 11:30am on SD |

9:00pm on S-1 through 11:30am on SD |

For more information on the T+1 changes for TradeSuite ID, click here.

It is important that Investment Managers obtain their own TradeSuite ID to automatically affirm trades, resulting in higher SDA rates, which will facilitate compliance with the SEC Rules. It also enables you to have visibility into when a confirm has been received and affirmed. To apply for your own TradeSuite ID, please visit TradeSuite ID Application Forms.

ITP Data Analytics is an operational performance measurement solution for broker/dealers and investment managers, which provide analytical tools for researching and optimizing the timeliness and accuracy of your trade processing. Please visit ITP Data Analytics to learn more about the different analytical reports available. One of the avaialble reports, the T+1 Scorecard, is designed to provide ITP clients with operational performance metrics and industry benchmarking across Enrichment (ALERT), Matching (CTM), and Affirmation (TradeSuite ID) to help clients.

ITPM Policies and Procedures - Documentation

DTCC ITP Service-Specific Terms Addendum

DTCC ITPM Central Matching Service Provider (CMSP) Policy

DTCC ITP Client Requirement Policy

DTCC ITPM's CMSP Requirements and Reporting FAQs

DTCC ITP Matching (US) LLC (ITPM) Central Matching Service Provider (CMSP) Annual Report

DTCC ITP Matching (US) LLC (ITPM) Central Matching Service Provider (CMSP) Annual Report Amendment