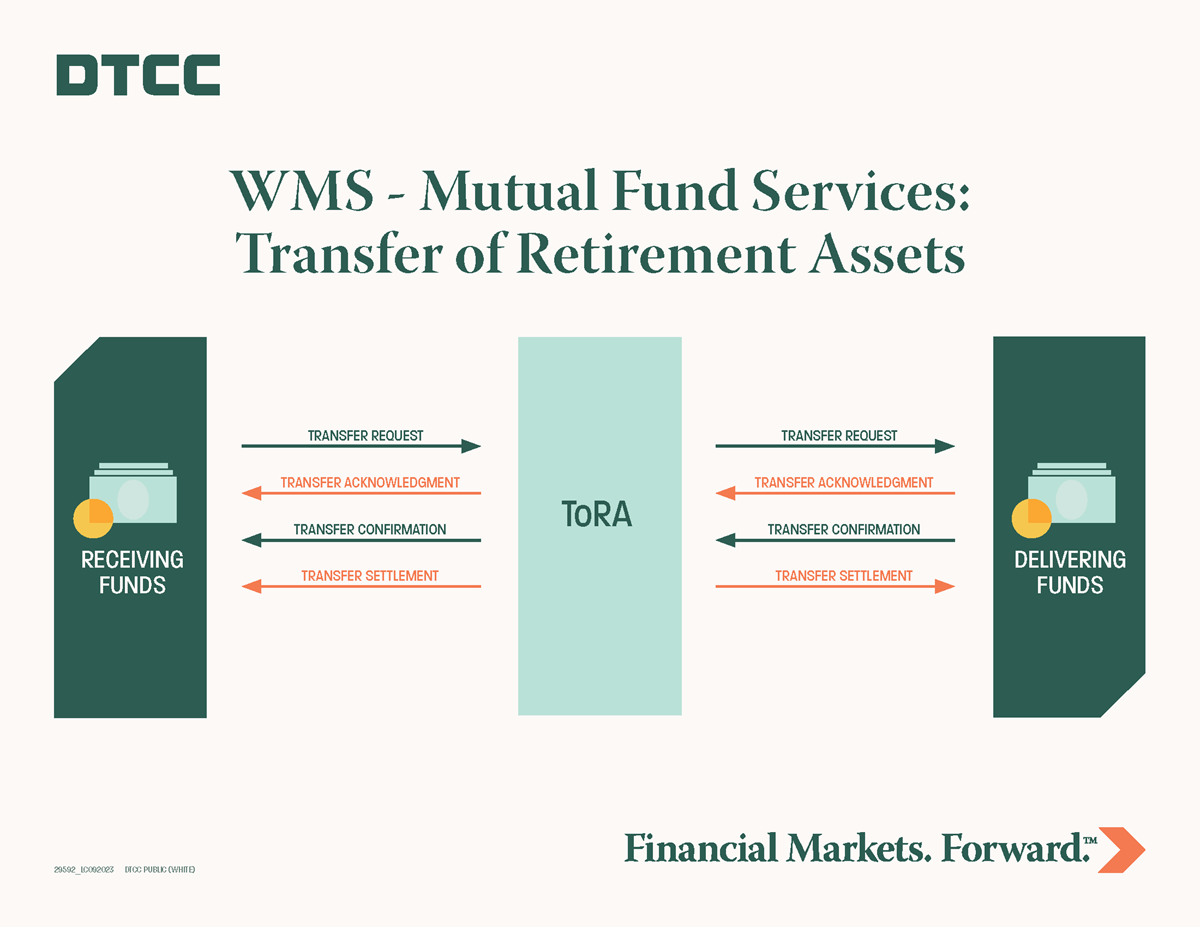

Transfer of Retirement Assets (ToRA) is used to systematically transfer retirement assets between two fund companies by selling assets at the delivering fund and buying them at the receiving fund.

Best Practices

Across the industry, fund families have different procedures for their associates to follow for ToRA transactions. In most instances, these procedures were developed using a combination of:

- Fund interpretation of legislation

- Fund interpretation of ToRA use guidelines

- Fund interpretation of shareholder expectations

Variances in these interpretations among fund companies can cause inconsistencies in the use of the ToRA product. These inconsistencies can make it difficult to know what to expect when requesting assets from another fund, in addition to complicating the reject resolution process. Fund companies are encouraged to review their current procedures with a critical eye, searching for ways to move these processes in line with the best practices outlined in the ToRA Business Guide.

Best Systems Practices

The ToRA Systems Guide was created to provide high-level technical instruction on how to code service provider and fund company systems.

If all service providers and fund companies code their systems according to the best practices defined in this document, ToRA trades will no longer reject due to inconsistencies between systems. Rejected trades result in a delay in the completion of transfers, which frustrates the shareholder and increases the cost of doing business for fund companies.

ToRA Business Guide

ToRA Systems Guide