The Settlement Web offers functionality which may be grouped into the areas shown below. Click the image below to open the Settlement Web Help. A new browser tab opens containing the online Help and allowing you to search all topics related to the Settlement Web. To learn what's covered in each of the below areas, click to expand the + signs below.

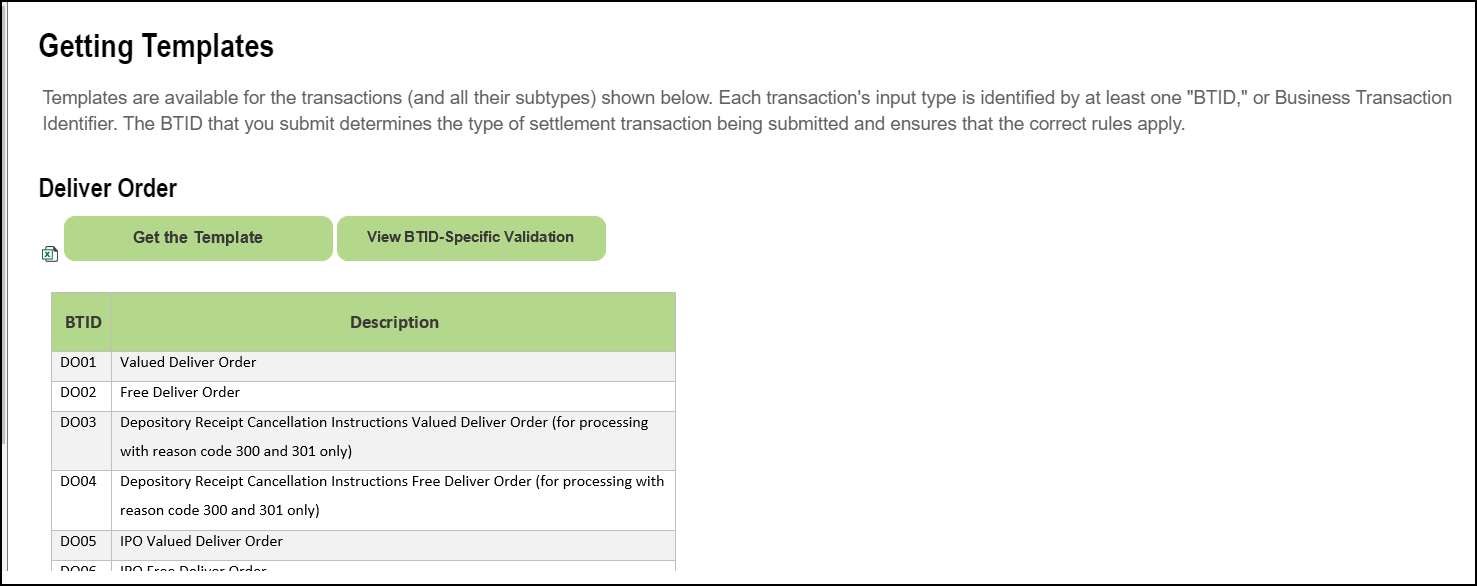

Clients may submit their deliver orders and payment orders to DTC using the Settlement Web interface. Transactions may be entered individually or uploaded via Excel spreadsheet templates accessible from the Settlement Web Online Help under the Transaction File Uploads> Getting Templates topic.

Asset, Security and Transaction Types That May be Submitted

Clients may submit transactions involving equity securities, such as common stock, as well as municipal and corporate debt securities, including money market instruments. Other types of securities movements that can be settled with DTC are institutional deliveries, stock loans and financing transactions, including the pledging of securities to the Federal Reserve, commercial banks, or the Options Clearing Corporation. Clients can also segregate fully-paid-for customer securities.

For more information:

- The Settlement Web Help. Refer to the Deliver Order, Payment Order, Collateral Loans, Position Movement sections. For bulk input, refer to the Transaction File Uploads section.

The Settlement Web provides the ability to monitor transaction activity and research daily position balances at the account and entity level.

Activity

Typical activities are deliver orders, payment orders, stock loans, pledge inputs and releases, and reclaims of these activities. All activities carry with them Activity codes which describe a DTC service such as deliver orders.

Example:

The Activity code that identifies and tracks deliver orders is Activity Code “26.”

Activity Inquiry

You can verify the status of deliver orders, payment orders, stock/loan, pledges, and other activities involving securities in the Activity Inquiry option. This option allows you to search across activities by deliverer or receiver, activity type, sub activity, free or valued transactions, Reason codes, MA/NA, and reclaim fields. Any searches may be saved and reused by accessing them on the Settlement Web Dashboard. Eligible transactions may also be canceled or reclaimed using command processing in the Data Grid.

Position

Several views of client security position are available.

- Position Inquiry – displays your current and historical position for a DTC-eligible security across activity categories (such as pledged, segregated, and stock loan/repo shares to name a few).

- Participant Activity Research Tool – shows daily shares/face value across all counterparties or a breakdown of one counterparty. This aggregated view allows research at the account and entity level by activity and asset type. A Collateral Loan search allows you to look up the prior day’s closing balances, market value, and outstanding loan details for any open pledges at your firm. A Journal History option provides a list of historical journal accounts at the CUSIP or date level. Journal entries are DTC Operations’ manually generated entries (usually a one-sided entry) done to balance accounts.

Note: It is the sole responsibility of DTC clients to perform a daily reconciliation of their activity and positions with the information, reports and statements provided by DTC.

Example:

A client submitted a stock loan request utilizing the Deliver Order Input function. To check the status of the stock loan position they will use the Position Inquiry function.

What is a Reason Code?

A Reason code defines the movement of shares or monies. Reason codes are used for processing, record-keeping, and for client reconciliation. Any time a client inputs a DO, PO, or collateral loan, a reason is indicated.

There can be several reasons for a DO: a delivery versus payment Reason code “30” defines the action or movement of shares against payment, whereas Reason code “40” defines the action or movement of shares with no payment.

When doing an audit to compare to your internal records, you can sort by Reason codes to insure our system will match your records. Reason codes are also useful in the identification of DKs (don’t knows).

Example:

A client makes a stock loan using the correct Reason code of “10.” If a distribution becomes payable, the client will receive this allocation.

For more information:

- The Settlement Web Help. Refer to the Activity Inquiry, Participant Activity Research Tool, and the Position Inquiry sections.

As clients prepare to ensure that their net settlement balance, if any, is settled they may review any transactions that are affected due to collateral deficiencies or risk management controls using the Pending Activity and Risk Management Controls Inquiry options.

Throughout the day different cutoffs occur for various transactions types, as outlined in the Settlement processing schedule. Any transactions not processed with a status of “Made” by these cutoffs will drop and be reintroduced to the settlement processor the following day. Clients may monitor their position and end of day cash balances in the Settlement Statements provided in the Settlement Web.

Finally, the Settling bank that settles on behalf of a client, acknowledges, or refuses to pay their DTC client’s net settlement balance, (after cross-endorsement with National Securities Clearing Corporation if the client is a dual NSCC and DTC member). The settling bank may perform this acknowledgement or refusal to pay the net debit or net credit balances in the Settling Bank Statements page.

Pending Activity

Pending Activity allows you to view transactions that are pending because your firm has insufficient position, collateral deficiencies, and/or debit cap deficiencies. Pending Transactions may also include CNS Long Allocations, CNS Short Covers and dropped activity due to input cutoffs. Participants have the option of holding and releasing held transactions. Participants place pending transactions on hold in order to prevent DTC from attempting to process the transactions. DTC will not attempt to process held transactions until the hold is released by the participant.

For More Information

- The Settlement Web Help. Refer to the Pending Activity section.

Risk Management Controls

Risk management controls protect you from the inability of one or more clients to meet their settlement obligations. Concepts include collateralization, net debit cap, and Issuer Participant Number (IPN) Collateral control (applies only to IPAs that issue their own MMIs.) See the Risk Management Controls Inquiry for a view of your risk management controls and any affected transactions.

For more information:

- The Settlement Web Help. Refer to the Risk Management Controls Inquiry section.

Settlement Statements

These relate to end of day money settlement balances which must be acknowledged or refused. Settling banks are required to and are able to acknowledge their settlement balance for the brokers/banks that they settle on behalf of with the Federal Reserve on a daily basis.

For more information:

- The Settlement Web Help. Refer to the Settlement Statements>Settling Bank Statements section - "Acknowledge and Refuse to Pay Procedures.”

Certain profiles allow you to manage the delivery, receipt, and approval of transactions sent to DTC for settlement. Profiles allow you to apply rules to transactions. Below are three major DTC systems that contain profiles. There are system default settings for these functions but you have the option to customize the profiles beyond the DTC defaults as part of your daily settlement operations.

Receiver Authorized Delivery (RAD)

RAD allows receivers to review and either approve or cancel incoming deliveries before they are processed. The receiver is the recipient of securities from the deliverer, often in exchange for payment.

For more information:

- The Settlement Web Help. Refer to the Receiver Authorized Delivery (RAD) Receiver Authorized Delivery (RAD) section.

IMS allows you to inquire about, authorize, or exempt securities eligible for settlement during the 6 business days beginning with S-1 (the day before settlement), and ending with S+5 (5 days after settlement).

For more information:

- The Settlement Web Help. Refer to the Inventory Management System user guide in the Resources tab.

- Refer to the IMS Setting Up Security and Drop Profiles videos in the Resources tab. Note: these describe the setup in the PBS Settlement platform.

Secondary Transaction Approval

Secondary Transaction Approval provides clients with the option to route Settlement Web-entered transactions to a queue for approval or cancellation prior to being submitted for processing at DTC.

For more information:

- The Settlement Web Help. Refer to the Secondary Transaction Approval section.