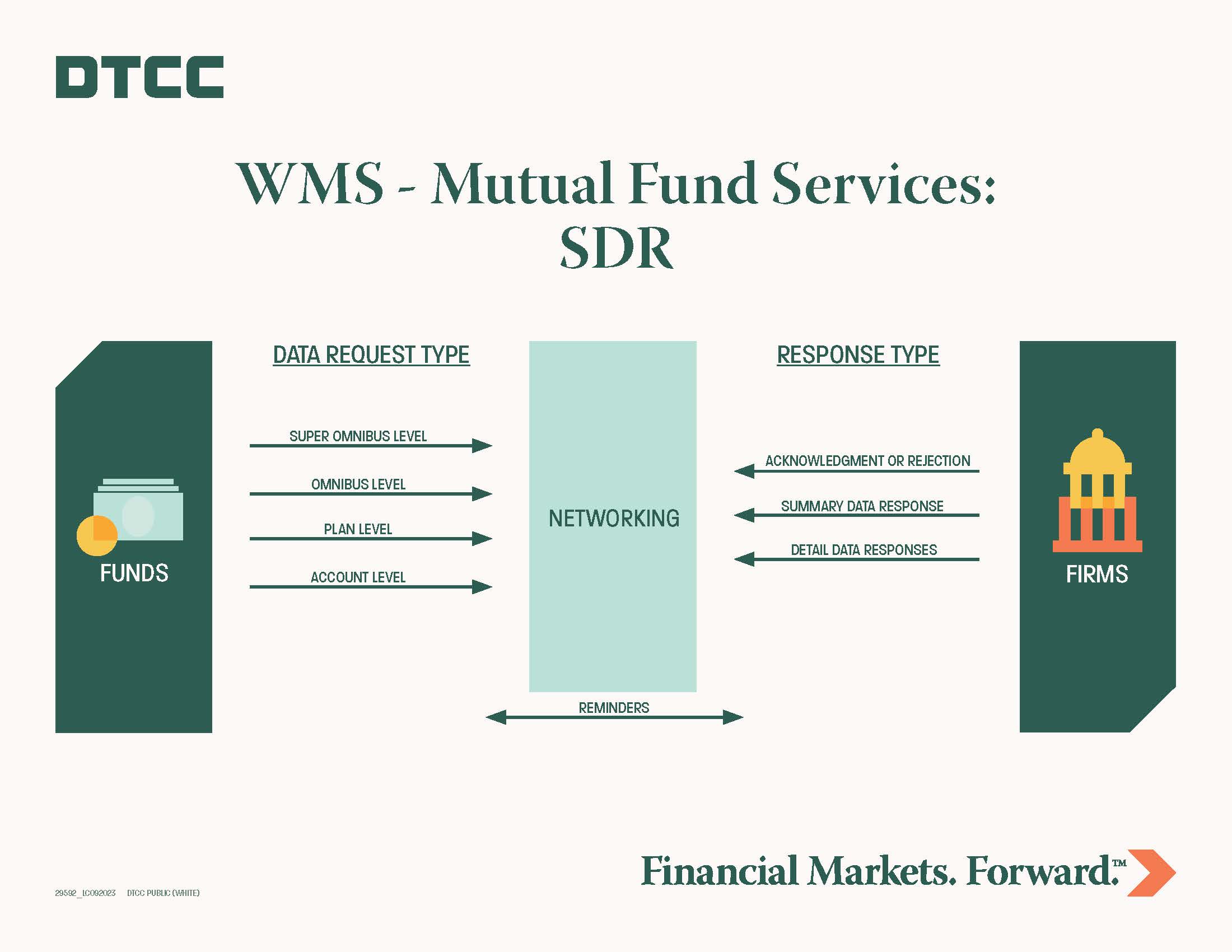

Standardized Data Reporting (SDR) enables Fund companies and insurance carriers to request and obtain shareholder identity and trading information from firms on two levels:

- At the summary-data level, where information is passed for super-omnibus accounts which are composed of multiple plans, trusts and/or investor omnibus accounts. This information may include account numbers and the dollar value of all shareholder buys and sells.

- At the detail data level, where information is passed on a specific account or at the shareholder-trading level.

SDR is accessible via mainframe over DTCC’s SMART connection.

SDR Guides

Standardized Data Reporting Best Practices

Standardized Data Reporting (SDR) Reject Code Reference Guide

Standardized Data Reporting Technical Guide

SDR Record Layouts

Networking Standardized Data Reporting

SDR Codes

In the below documents you can find more detailed information on both the SDR Transaction Codes and the SDR Reject Codes.

Standardized Data Reporting (SDR) Transaction Codes

Standardized Data Reporting (SDR) Reject Codes