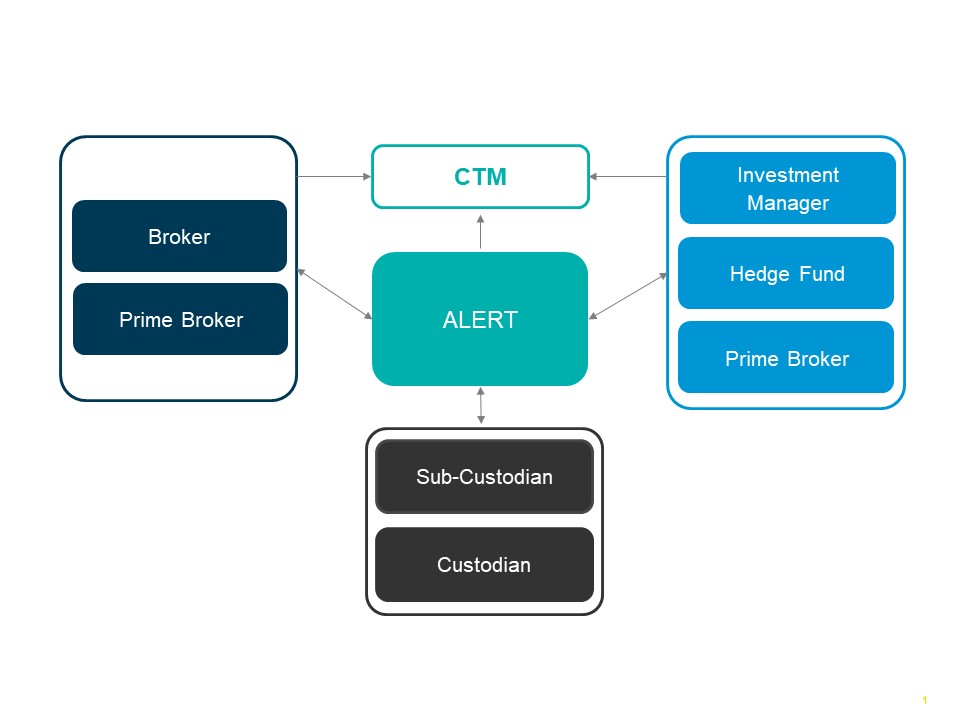

The ALERT® platform is the industry’s largest and most compliant online global database for the maintenance and communication of account and standing settlement instructions (SSI), enabling a global community of investment managers, brokers/dealers and custodian banks to share account and SSI data accurately and automatically.

This overview section is aimed at those getting started with the ALERT product family. You can explore the ALERT services either by Role, further down the page, or by Product offering, under the Related Content section. You can find Technical documentation to support your implementation and set-up at the bottom of this page.

For functionality and SSI data set-up, follow the SSI Management menu and select the path most appropriate to your needs.

ALERT Services by Role

How your team interacts with ALERT will depend on your role and the ALERT feature you elect to utilise. Learn more about the different flavours of ALERT, by clicking the appropriate section, below:

ALERT allows buy-side clients to set up or edit accounts and maintain the SSIs associated with those accounts. Buy-side clients can link accounts to a set of existing instructions they have created using models, or SSI maintenance may be handled by Global or Regional Custodians by both the web service as well as by GC Direct, for those (GC) Direct-enabled global custodians and prime brokers. Account access can be restricted to only those broker-dealers with whom you actively trade, and your permissioned broker-dealers are notified of your instruction changes by the electronic Alerting process within ALERT. You can also retrieve broker-dealer SSIs online when needed.

ALERT features relevant to buy-side clients are: ALERT Web, Global Custodian Direct, ALERT ASSIsT, and ALERT Plus.

Find more indepth guidance for each ALERT feature from the links or Related Content Section on this page.

ALERT facilitates the communication of a wide range of settlement instructions to our sell-side clients who receive updates to settlement instructions from the buy-side via an electronic Alerting process within ALERT. Sell-side clients also retrieve settlement instructions on a trade-by-trade basis through enrichment within the Institutional Trade Processing (ITP) service suite. To expedite processing, the sell-side can link the buy-side's account codes (Access Codes) to their own internal account numbers (Broker Internal Accounts or BIAs) which ensures the retrieval of Alerts that pertain to those specific buy-side accounts of interest.

ALERT features relevant to sell-side clients are: ALERT Web and ALERT Direct.

Find more indepth guidance for each ALERT feature from the Related Content Section on this page.

With ALERT GC Direct, custodian banks and prime brokers can electronically manage settlement instructions through ALERT on behalf of their buy-side clients. This enhanced custodian and prime broker access enables them to become the owner and maintainer of SSIs using dedicated ISO 20022 compliant messages. The automated exchange of SSIs between a custodian’s central repository and the ALERT host ensures sensitive settlement data is secure. Future effective SSI updates can also be managed so custodian banks and prime brokers can proactively update their buy-side clients of pending market changes.

ALERT features relevant to custodian banks and prime brokers are: ALERT Global Custodian Web, ALERT Global Custodian Direct for Global Custodians, ALERT Global Custodian Direct for Regional Custodians, and ALERT Plus for Global Custodians.

Find more indepth guidance for each ALERT feature from the Related Content Section on this page.

Technical Guidance

The below documents are key resources for any ALERT initial implementation.

Find service-specific indepth technical guidance by selecting your required service from the Related Content Section on this page.

ALERT Common Reference Data

ALERT Data Search Reports

The below documents outline the most recent ALERT enhancements:

ALERT Release Information

User and product management is instrumental in the successful adoption and implementation of ALERT. Find out what each entails below, and where to find guidance and support:

The Product Administrator plays an important role in administering your organization’s access rights and profiles for ITP products, liaising between your organization and the DTCC. Their responsibilities include:

- Managing users

- Managing other product administrators

- Updating product profiles

- Monitoring existing requests

Learn more about Product Administrators and their administration tool, MyDTCC Portal.

Data Authentication (DA) is the process that the ALERT platform uses to authenticate the entry, deletion, and modification of ALERT platform data. It can be used by both broker/dealer and investment manager client types and can be applied to the following data types:

| Data Type | Broker/ Dealer | Investment Manager |

| Account Settlement Instructions | X | |

| Broker Access | X | |

| General Account | X | |

| Market Activation | X | |

| Model Settlement Instructions | X | X |

By default, Model and Account Settlement Instruction changes will require a minimum of two levels of Data Authentication for F/X, Cash and Derivative instructions. Clients can then choose to apply Data Authentication to other data types. The levels of authentication are defined as follows:

- None

- 2 levels (Creation + Approval)

- 3 levels (Creation + Approval + Authorization)

Clients can therefore set up their users to be Creators, Approvers and/or Authorizers, however the same user can not complete 2 subsequent steps in the Data Authentication process. Using MyDTCC Portal, individuals who have been designated as a Data Authentication Administrator control the roles applied to other users and the number of levels of authentication required.

DTCC highly recommends that you promptly action any pending items in your Data Authentication queues.

For more in-depth information about how to access MyDTCC, visit our MyDTCC page to learn more.

DART Requests

All ALERT client types who require an extract of data from ALERT can submit a request for a DART report, output in the format of a Microsoft Excel file. Please note this service is chargeable and you will be requested to provide billing details when submitting a request.

Full details on how to request a DART report are below, including which fields to populate depending on the type of data you are requesting. You can also review the ALERT Data Search reports documentation.

1. Log in to MyDTCC. Learn more about the site and how to register for an account here.

2. Under Support, select Support Request.

3. Within Open A New Request, select:

- Product or Service: ALERT

- Topic: Data & Reports

- Subject: DART Report

3. In Enter Details, enter your own ALERT acronym in the ALERT Acronym field,

4. Depending on the type of data you want to be included in the extract, populate the remaining fields below as shown in the table. When requesting counterparty data, you can select all acronyms or specify those that you require access to.

| Who is requesting the data? | Do you want your own data or your counterparties data? | If counterparty data, what type of client are they? |

What type of ALERT data is required? (select the relevant check box) |

|

| Scenario 1: Broker requesting IM accounts | Broker | Counterparty | Institution | General Account Instructions |

| Scenario 2: Broker requesting IM SSIs | Broker | Counterparty | Institution | Account Settlement Instructions |

| Scenario 3: Broker requesting own SSIs | Broker | Own | N/A | Institution Settlement Model Instructions |

| Scenario 4: IM requesting their own accounts | Institution | Own | N/A | General Account Instructions |

| Scenario 5: IM requesting their own SSIs | Institution | Own | N/A | Account Settlement Instructions |

| Scenario 6: IM requesting Broker SSIs | Institution | Counterparty | Broker | Institution Settlement Model Instructions |

5. For Settlement Model Instruction requests, if you want to restrict the data extract to certain Country, Security or Method types, please specify.

6. If you are a broker requesting counterparty data (Scenarios 1 and 2), answer the additional questions under Additional options for Broker clients. If you want to include BIAs, the DART report will include your BIA number in the data extract where one exists. If you only want to include cross-referenced accounts, select Cross-referenced Account only. Otherwise, choose All Institution Accounts.

7. Complete all billing information.

8. Once all information is complete, click Submit. You will receive a confirmation email from DTCC Client Operations confirming your request.