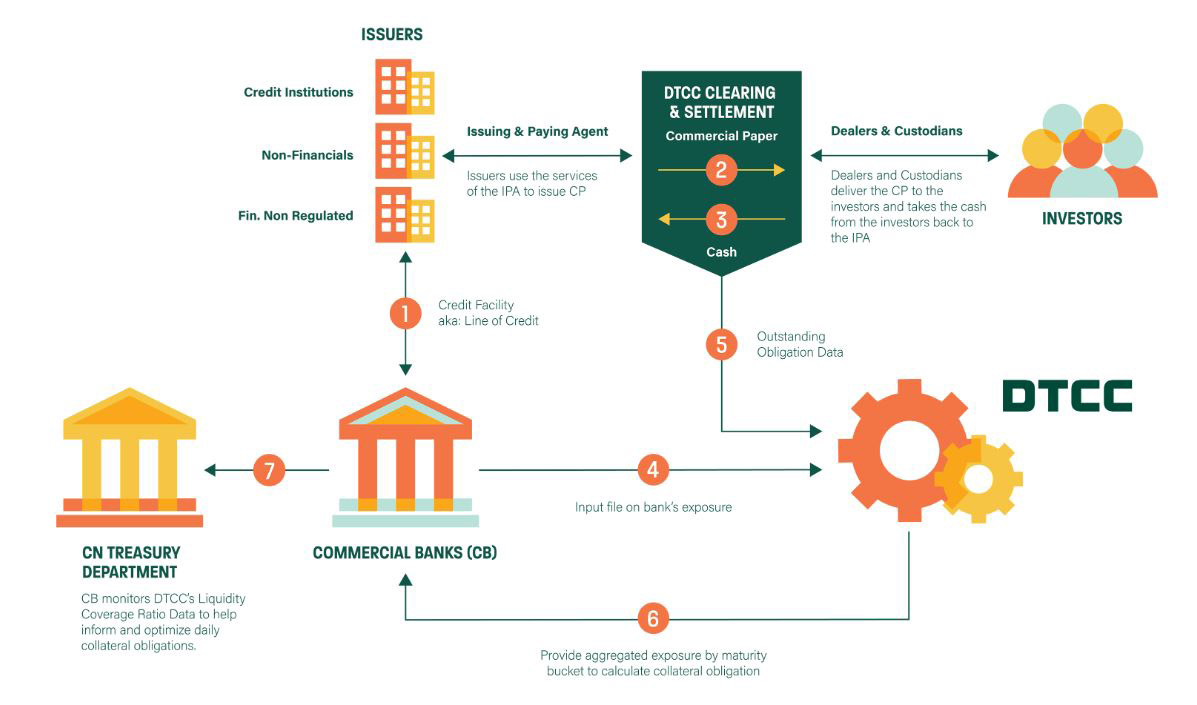

DTCC’s Liquidity Coverage Ratio (LCR) Service provides a precise profile of a firm’s coverage obligation for the firm’s daily CP portfolio delivered in a daily, start-of-day CSV file. The service delivers transparency to firms and provides visibility to CP outstanding and CP maturity dates, giving firms the ability to manage with heightened precision the cash coverage for their CP obligations. While meeting today’s more-stringent regulatory mandates, market participants actively trading or holding CP, including firms’ Money Market Trading Desks and Treasury Groups, seek cost-efficient ways to enhance visibility into the obligations for the CP for which they provide loan commitments.

The LCR Service prepares a detailed profile of a firm’s current CP portfolio with obligations mapped by maturity—from seven days up to one year—and uses this information to compute the up-to-date liquidity-coverage ratio necessary to facilitate compliance with capital requirements. Utilizing data on outstanding obligations from daily feeds received by DTCC’s depository subsidiary, Depository Trust Company (DTC), in conjunction with firms’ CP portfolio data, the LCR service calculates and provides overnight delivery of customized information to help firms better optimize the capital required to meet their current, mandated obligations.