The ClaimConnect™ service is a solution to the industry's challenges in handling claims that may not be tracked by DTC. These include:

- Securities Lending (Lends/Borrows)

- Short Settled Trades

- Differences in Tax Rates

- Not fail tracked (CNS/DTC)

...and other trades that fall outside of DTC's Corporate Actions processing services.

The ClaimConnect™ service eliminates the need for dedicated departments and e-mail reconciliation and is offered by the Depository Trust Company (DTC), a subsidiary of DTCC.

Please log in and expand the sections below to learn more. Review the Related Content links to access ClaimConnect™ - related documents, Help, and FAQs. All learning solutions may also be accessed via the Resources tab at the top of this page.

Watch the recording of the ClaimConnectTM application demo presented on July 2, 2021.

Topics include:

- the retirement of the Adjustment Payment Order (APO) function from CA Web;

- accessing ClaimConnect via the MyDTCC portal;

- the ClaimConnect Dashboard,

- an overview of claims from both the submitter side and the receiver side;

- using the Claim Search Engine;

- entering claims in ClaimConnect;

- viewing a Client Profile;

- uploading documents to claims;

- the ClaimConnect approval process, and more.

Presented by Matt Schill - Product Manager, Asset Services. Viewing time: 54 minutes.

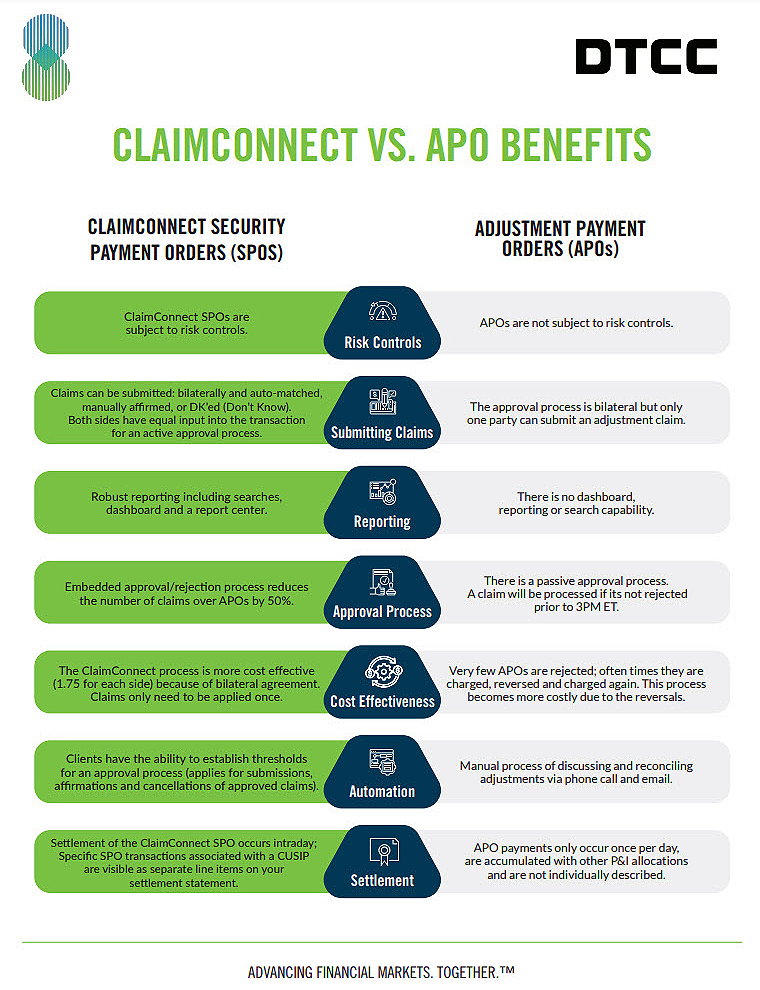

Interested in understanding the benefits of ClaimConnect Security Payment Orders (SPOs) vs. Adjustment Payment Orders (APOs) as previously processed in CA Web? Check out the graphic below!

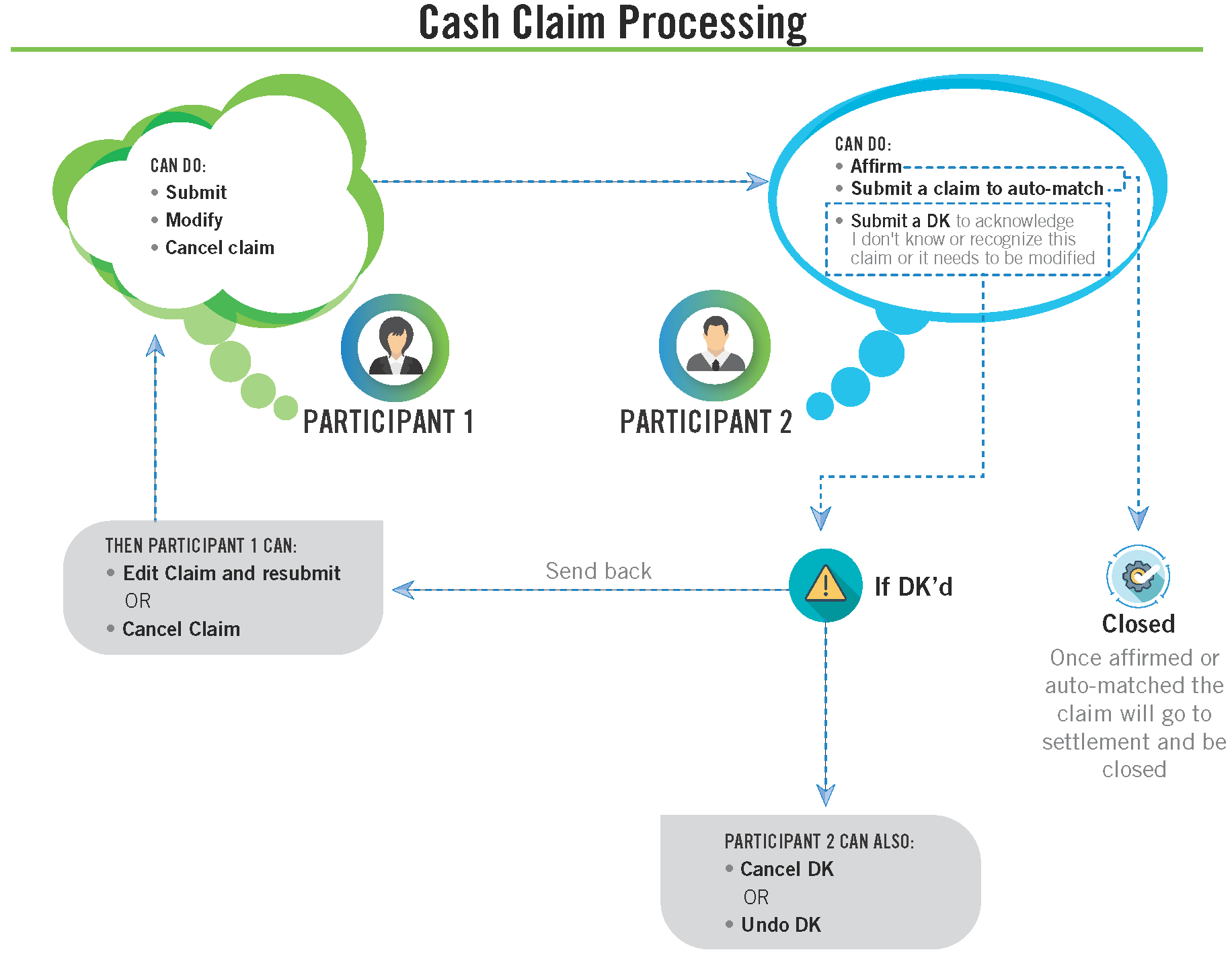

The image below shows the cash claim processing flow.

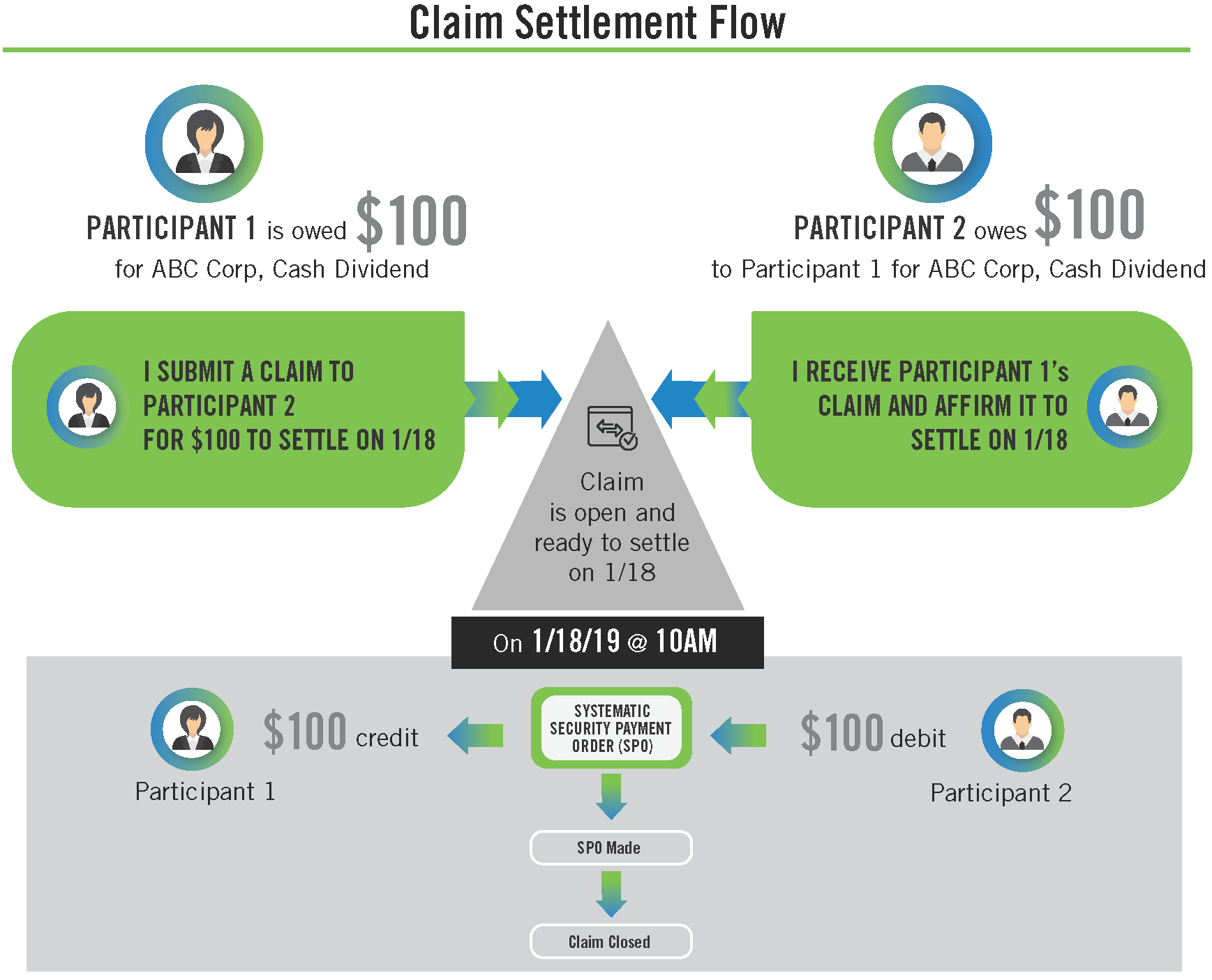

The image below shows the cash claim settlement flow.

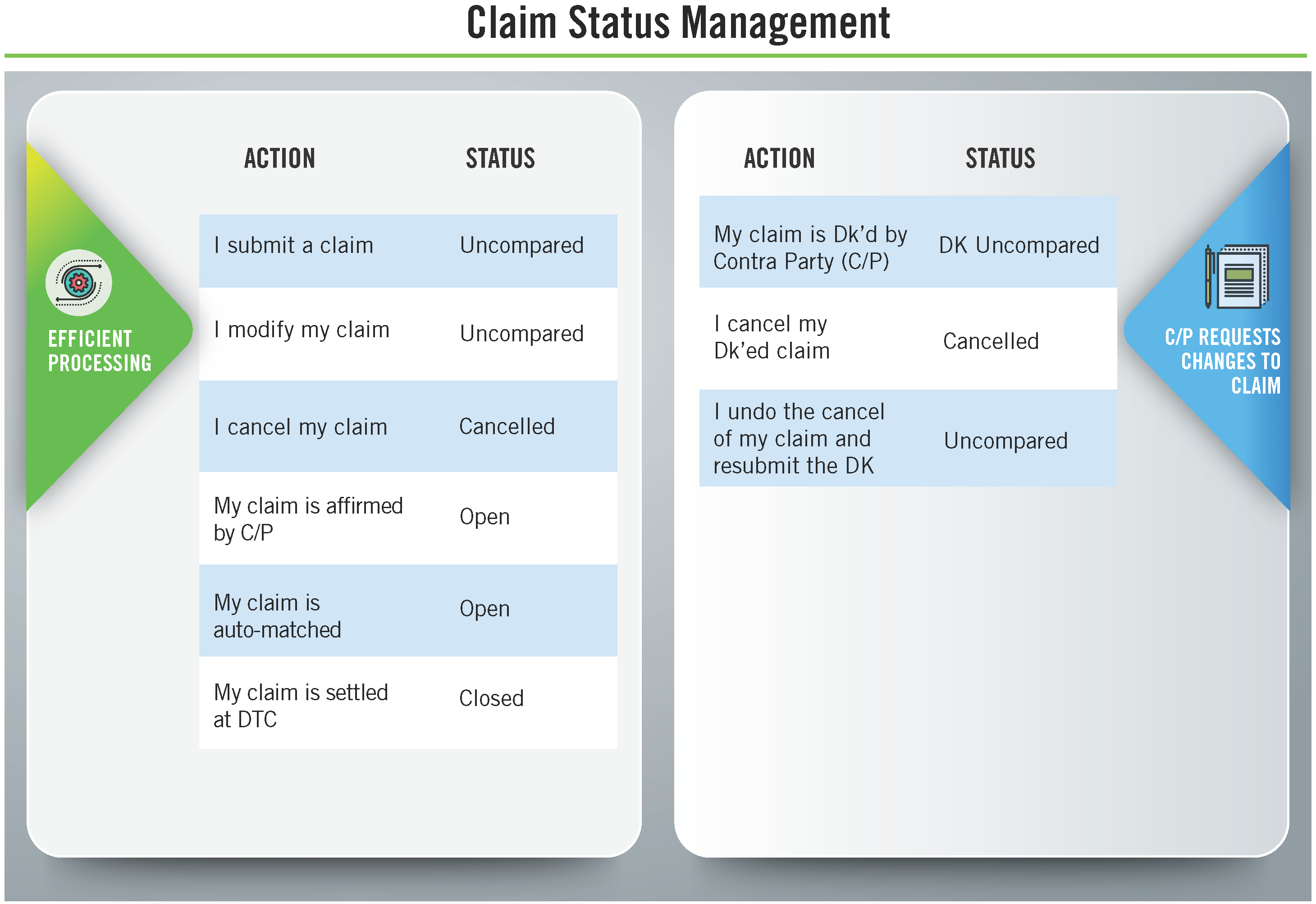

The image below shows actions vs. claim statuses.