Legal Entity Identifier

The Legal Entity Identifier (LEI) is a reference data tool to standardize how a counterparty is identified on financial transactions. Its goal is to help improve the measuring and monitoring of systemic risk and support more cost-effective compliance with regulatory reporting requirements.

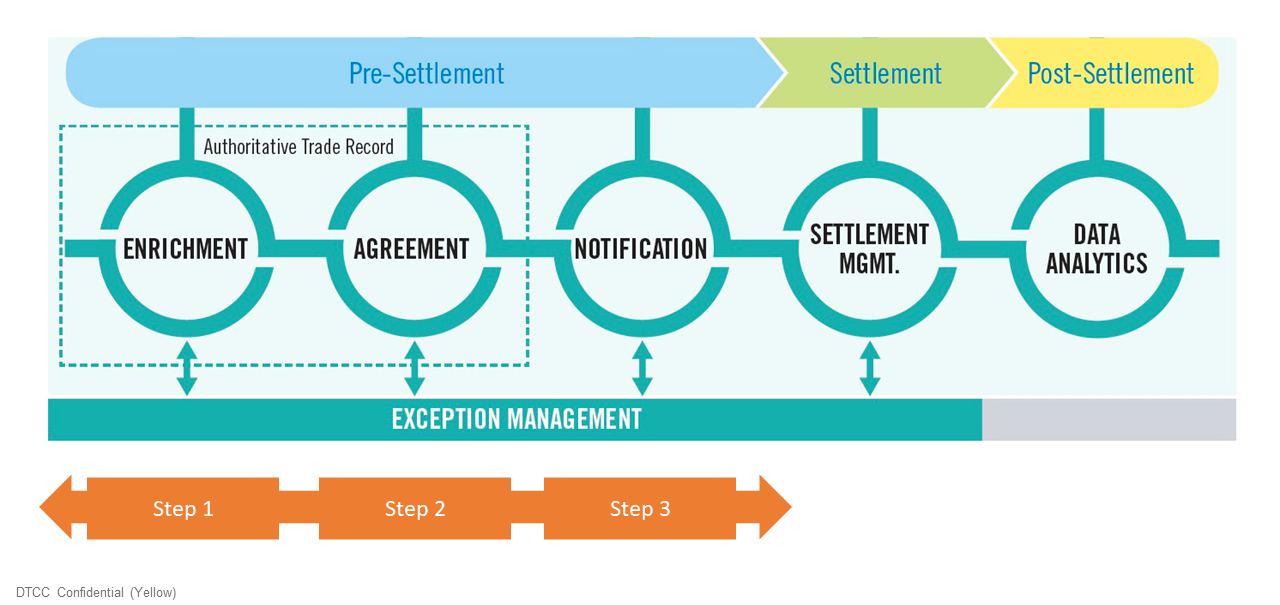

Through its suite of ITP products and services, DTCC provides our clients with the ability to communicate their LEI to their counterparties (ALERT) and enrich this information on to their authoritative trade records (CTM), making it available as part of the enriched SSIs which can then be used downstream in the settlement process.

Below is a step-by-step guide on how to maximize usage of your LEI(s) and be in compliance with MiFID II Regulation.

The ALERT platform contains functionality enabling users to share their LEI with their counterparties. Where this information is populated will depend on whether you are an investment manager or broker/dealer user of ALERT.

For Investment Managers

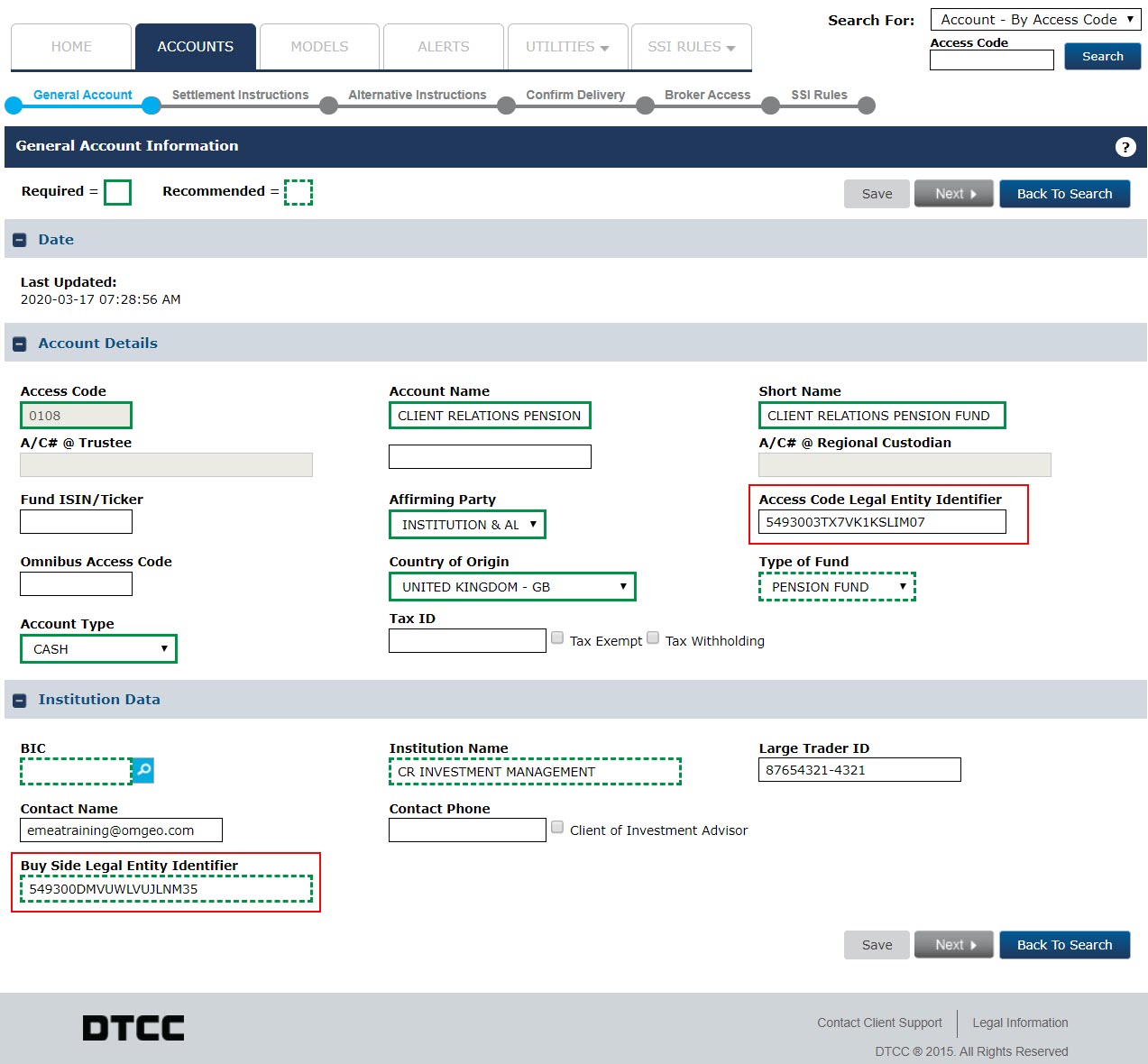

Investment Managers can provide an acronym-level LEI (Buy Side Legal Entity Identifier) which represents their organization as a legal entity and/or a fund-level LEI (Access Code Legal Entity Identifier), both of which are populated on the General Account Information screen of each ALERT account.

It is possible to run a General Account Data Search report to determine whether a LEI has already been applied to accounts, allowing investment managers to identify gaps in the provision of their LEI data. To run this type of report, follow the instructions below:

- When logged into ALERT, select Utilities - Data Search - General Account Data

- Populate the Settlement Instruction Controller field with either your own acronym or your Global Custodian's acronym for Global Custodian Direct-managed accounts

- Click Search to retrieve all accounts

- When the list of accounts is complete, click Save to Excel

5. Name the report and click OK

6. After generating the report, the ALERT platform sends an email confirmng that it is available to view

7. To view the report, go to Utilities - Reports Run and click on the report name

8. Check the columns for Access Code Legal Identifier and Buy Side Legal Entity Identifier for previously provided values.

For Broker/Dealers

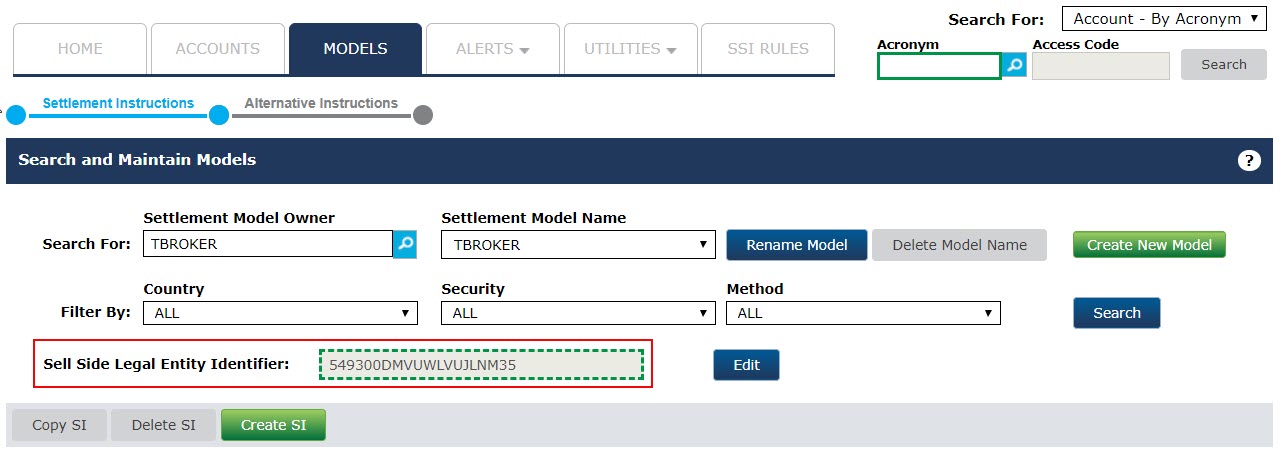

Broker/dealers provide their organization-level LEI within the Settlement Model - Search and Maintain Models screen.

LEI information added to ALERT will then be enriched onto allocations within the CTM service, which then makes it available for use during settlement processing and for regulatory reporting. This information can be accessed from the CTM User Interface 3.0 by selecting any allocation and View Settlement Instructions and from the CTM User Interface 4.0 by selecting any allocation and View SSI.

The below view from the CTM User Interface 4.0 is from an investment manager's perspective therefore the investment manager's LEI and the fund-level LEI appear in the My Side section, whilst the broker/dealer's LEI appears in the Counterparty section.

Institutional |Trade Processing also offers an optional Settlement Instruction Manager feature enabling investment managers to achieve straight through processing of matched trades through the automatic creation and transmission of settlement instruction messages in industry standard formats, including SWIFT MT54x messages.

If the investment manager adopts the LEI subscription option (TLEI), their brokers' LEIs will be included in the settlement instruction message. In order to turn this subscription option on, Product Administrators will need to submit a case to the DTCC Client Center.