Buy/sell transactions of U.S. Government Securities can be netted for next day or forward settlement with up to 365 days extended settlement. Same-day settling buy/sell transactions must be submitted to GSD for comparison, but such transactions are not cleared through GSD.

Trade comparison of buy/sell transactions occurs through bilateral comparison, except for auction purchases which are submitted directly to GSD by the Federal Reserve Bank of New York (or a regional Federal Reserve Bank) on a locked-in basis.

Bilateral comparison requires that the two trade counterparties submit trades to GSD, in which certain mandatory details either match or fall within predefined parameters, to affect a match. Bilateral is the primary comparison type for dealer-to-dealer trades. Submission of buy/sell transactions can be submitted via interactive messaging or through the GSD RTTM® Web Front End (WFE) .

GSD deems a trade compared at the point when it makes available to the Netting Members on both sides of the transaction a Report indicating that the trade data has been compared.

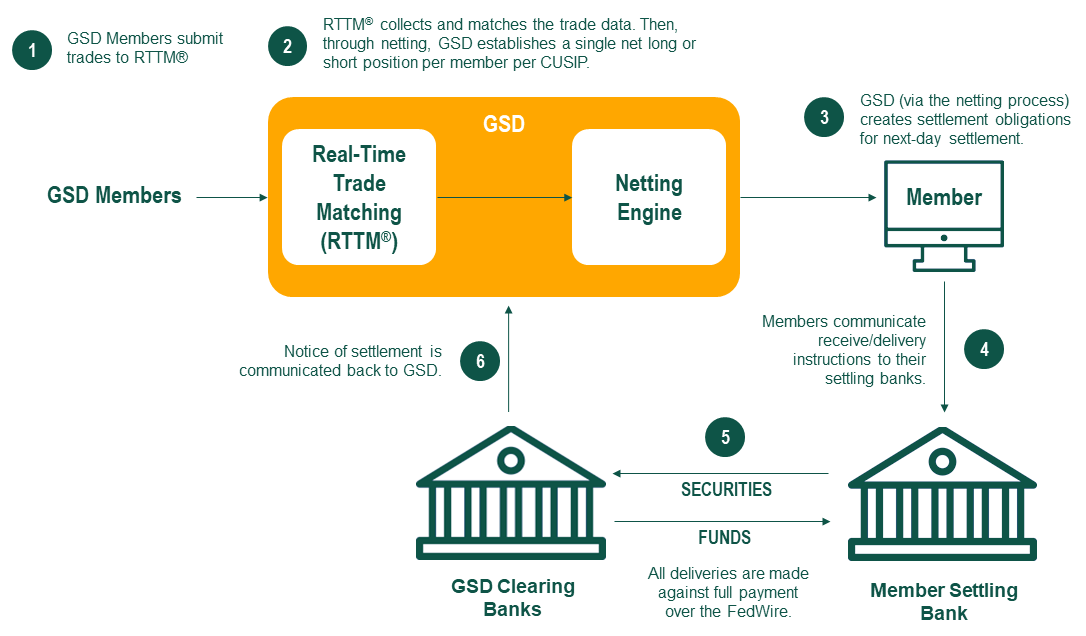

Take a look at the DVP Buy/Sell Flow Chart below.

Steps in the process are:

- GSD Members submit trades via RTTM® WFE or through interactive messaging.

- RTTM collects and matches the trade data. Then, through the netting process, GSD establishes a single net long or short position per Member per CUSIP.

- Once net positions are generated, settlement obligations are communicated to the Members.

- Members will communicate receive and delivery instructions to their settling banks.

- All deliver and receive obligations are settled through the GSD against full payment.

- Finally, notice of settlement is communicated back to GSD and the Members.