Obligation Warehouse Users

- Details

The Obligation Warehouse Web system is a secure, efficient obligation entry and management system that incorporates robust search capabilities, statistical reporting, and exception processing. Eligible member can use the service to access real-time information along with input and response capabilities. The commands and data are validated in real-time, input errors are reported immediately, and invalid data elements are returned directly on the entry page. Every obligation submitted, as well as the subsequent related events, are sent to the Contra to provide both parties with the most updated status. All output files are parsed into sections and defined as reports readily available for up to two years in the Report Center.

Using Obligation Warehouse Web, participants can enter ex-clearing broker-to-broker obligations, obtain real-time matching, clean up exceptions, store open obligations, check for CNS eligibility daily, and run RECAPS frequently. The Obligation Warehouse Web feature allows you to:

- Perform obligation entry, modification, delivery notification, and cancellation.

- View, affirm, or don't know (DK) advisories.

- Immediately identify and resolve exceptions.

- Research obligation exceptions using a search engine.

- View all matched and uncompared obligation entries by currency, security, status, contra, or a combination of criteria.

- Export obligation details or query results to Excel spreadsheets.

- Reduce delays associated with batch processing and manual comparison

- View every obligation regardless of the status.

- Enable you to quickly recognize aged obligations to assist in the confirmation and resolution process.

- Access end of day Obligation Warehouse reports, both today and historically.

Log in to view information about how to access and use the Obligation Warehouse Web system, including avoiding fee guidelines available in the Avoiding Disincentive Fees resource. You can also access the Obligation Warehouse Help to learn more about process rules, input and output features, RECAPS, REORGs, and using the Obligation Warehouse Web service.

{docmanlist orderByOrder 1107}

Obligation Warehouse Technical Resources

- Details

The Obligation Warehouse service is a common repository for trade capture and clearing transactions from the marketplaces, including the listed exchanges and alternative trading platforms collectively. The service consolidates those transactions to reduce the burden of trade-for-trade settlement for each transaction.

Log in to view the input and output message layouts, MRO files, sample reports, and SWIFT messaging specifications.

NSCC Network Connectivity

{docmanlist orderByOrder 1768}

NSCC File Formats and MRO Files

Input and output formats for the Obligation Warehouse service:

{docmanlist orderByOrder 1110}

Machine readable output (MRO) files for the Obligation Warehouse service:

{docmanlist orderByOrder 1111}

Participant Interactive Messaging Specifications

{docmanlist orderByOrder 1112}

SWIFT Messaging Specifications

Obligation Warehouse SWIFT MT509 messages:

{docmanlist orderByOrder 1114}

Obligation Warehouse SWIFT MT515 messages:

{docmanlist orderByOrder 1115}

Obligation Warehouse SWIFT MT518 messages:

{docmanlist orderByOrder 1116}

Obligation Warehouse SWIFT MT598 messages:

{docmanlist orderByOrder 1117}

Obligation Warehouse SWIFT MT599 messages:

{docmanlist orderByOrder 1118}

Related Content

ACATS Best Practices

- Details

Log in to view the best practices for the ACATS system.

Note: DTCC is modernizing the client interfaces that firms use to communicate with the ACATS systems. The client interface enhancements also include features to process 529 accounts transfers through the ACATS Fund/SERV® service. To access resources for these client interface enhancements, see the ACATS Projects section.

{docmanlist orderByOrder 1053}

See Also:

ACATS Projects

- Details

Log in to view information about recently implemented enhancements along with plans for current and future ACATS releases.

Settle Prep and Fund/SERV Day 2 Acknowledgment Removal (2025)

To help you prepare for the removal of the 300-Settle Prep status and ACATS Fund/SERV® Day 2 acknowledgments, review the requirements and implementation guide along with the updates to the legacy variable output formats for ACATS. You can access the ACATS Output Fromat (Legacy) resources in the ACATS Technical Resources section. See also: ACATS Important Notices.

ACATS Settle Prep (Status 300) Removal

The first day in which a transfer does not stage to the 300-Settle Prep status at the end of the day:

- PSE/Test – Friday, July 25, 2025

- Production – Friday, October 17, 2025

ACATS Fund/SERV Day 2 Acknowledgment Removal (applies only to Fund Companies/Transfer Agents)

The last day you can receive a Pending status or Day 2 Acknowledgement on the Fund/SERV statistics report:

- PSE/Test – Monday, July 28, 2025

- Production – Monday, October 20, 2025

{docmanlist orderByOrder 1907}

Client Interface Modernization and ACATS 529 Plan (2023 - 2026)

Learn about the new ACATS client interface enhancements that will modernize the client interfaces that firms use to communicate with the ACATS systems. These enhancements also include features to process 529 accounts transfers through the ACATS Fund/SERV® service. DTCC has updated its API Marketplace with the ACATS APIs, schemas, and API Starter Kit for the new JSON standard message formats. For full access to the DTCC API Marketplace, contact your firm’s Super Access Coordinator (SAC) to enable you as an Operator.

For SACs: If you are unable to provision entitlements to the API Marketplace, contact NSCC Integration at

After logging in, expand each section to access the ACATS modernization resources.

View answers to common questions, such as how to automatically reset your password.

{docmanlist orderByOrder 1739}

{docmanlist orderByOrder 1687}

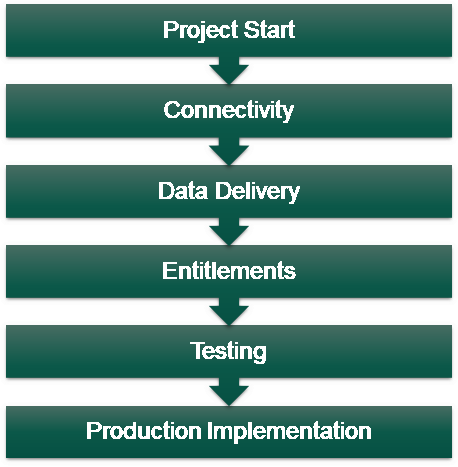

Project Workflow

Real Time Messaging (MQ)

- Available for input and output

- Only option for output

- New channel builds are required for use of ACATS MQ for inbound and outbound

- Data Delivery

- Testing

- Testing sign-off

- Production Implementation

API

- Available for input only (at this time)

- DTCC API Marketplace, entitlement needed

- Robot ID buildout

- Testing

- Testing Sign-off

- Production Implementation

Next Steps

When you are ready to engage with us, email Contact NSCC Integration at

Click each tab to access the ACATS input and output JavaScript Object Notation (JSON) formats, egress schema, and sample JSONs.

View the JSON input formats that are supported with the API Marketplace or Message Queue (MQ) specifications. You can also download the Ingress Schema zip file to view the input JSON schema.

{docmanlist orderByOrder 1688}

View the JSON output formats that are supported only through MQ. You can also download the Egress Schema zip file to view the output JSON schema.

{docmanlist orderByOrder 1697}

View the sample JSONs available in PDF or by downloading the zip containing the following samples:

- Multicycle Transaction Sample JSON

- End-of-Day Transaction Sample JSON

- Position Sample JSON

- Settlement Sample JSON

- Insurance Statistics Sample JSON

- Interface Rejects Sample JSON

- Fund/SERV Statistics Sample JSON

- End of Message (EOM) Notification Sample JSON

- CNS/NON-CNS Reversals

- Mutual Funds Reversals

See Also: View sample requests and responses in the ACATS Message Queue (MQ) Guide. For detailed information about the JSON input structure and usage, see DTCC API Marketplace.

{docmanlist orderByOrder 1698}

View the network connectivity guide that provides the ACATS URLs in the PSE and production environments.

{docmanlist orderByOrder 1054}

{docmanlist orderByOrder 1743}

Alternative Investments (2022)

{docmanlist orderByOrder 1649}

CBRS Overview

- Details

The Cost Basis Reporting Service (CBRS) system mitigates potential endless paper trails, extra charges, and added operational risk associated with firms manually transferring their cost basis information. The CBRS application extends its automated efficiencies and capabilities to transfer agents, issuers, mutual funds, custodian banks, and broker/dealers to support the transfer of cost basis information from one firm to another for any asset transfer.

Page 5 of 6