TARGET2-Securities is a platform that centralizes the delivery-versus-payment settlement in central bank funds across all European securities markets. Intended to integrate and harmonize the fragmented securities settlement infrastructure in Europe into a single market infrastructure solution, T2S enables one Central Securities Depository (CSD) to be the CSD for any other T2S market securities, upon approval. This setup allows settlement of the securities in a different CSD from the issuer, which is generally referred to as the Investor CSD model.

ITP has made various updates to accommodate for this workflow, full details of which can be found below. All ALERT and CTM clients should be aware of the changes and make sure they are following best practices to ensure smooth settlement. The below grid summarizes the impact if you do/don't implement these changes within your workflow.

| BOTH USE STANDARD PSET | CUSTODIAN USES INVESTOR CSD MODEL | BROKER USES INVESTOR CSD MODEL | BOTH USE INVESTOR CSD MODEL | |

| NO SETTING | Clients should see no impact Clients should see no impact | Settlement instruction (sent by Settlement Instruction Manager) and CTM Info Settle Response Message will not have a PSAF value which could impact settlement |

Settlement instruction (sent by Settlement Instruction Manager) and CTM Info Settle Response Message will not have a PSAF value which could impact settlement |

Settlement instruction (sent by Settlement Instruction Manager) and CTM Info Settle Response Message will not have a PSAF value which could impact settlement |

| PSET MATCHING ONLY | Clients should see no impact Clients should see no impact | Settlement instruction (sent by Settlement Instruction Manager) and CTM Info Settle Response Message will not have a PSAF value which could impact settlement | Settlement instruction (sent by Settlement Instruction Manager) and CTM Info Settle Response Message will not have a PSAF value which could impact settlement | Settlement instruction (sent by Settlement Instruction Manager) and CTM Info Settle Response Message will not have a PSAF value which could impact settlement |

| CBIC ONLY | Update will only copy PSET to PSAF if values are different Update will only copy PSET to PSAF if values are different | Settlement instruction (sent by Settlement Instruction Manager) and CTM Info Settle Response Message will correctly have differing PSAF and PSET values. Clients should use this information to ensure there is no impact to settlement. For non-T2S combinations, PSAF may be incorrect if PSET matching has not also been applied | Settlement instruction (sent by Settlement Instruction Manager) and CTM Info Settle Response Message will correctly have differing PSAF and PSET values. Clients should use this information to ensure there is no impact to settlement. For non-T2S combinations, PSAF may be incorrect if PSET matching has not also been applied | Settlement instruction (sent by Settlement Instruction Manager) and CTM Info Settle Response Message will correctly have differing PSAF and PSET values. Clients should use this information to ensure there is no impact to settlement. For non-T2S combinations, PSAF may be incorrect if PSET matching has not also been applied |

| BOTH PSET MATCHING AND CBIC | Update will only copy PSET to PSAF if values are different Update will only copy PSET to PSAF if values are different | Settlement instruction (sent by Settlement Instruction Manager) and CTM Info Settle Response Message wil have a different PSAF value. Clients need to use information so there is no impact to settlement | Settlement instruction (sent by Settlement Instruction Manager) and CTM Info Settle Response Message wil have a different PSAF value. Clients need to use information so there is no impact to settlement | Settlement instruction (sent by Settlement Instruction Manager) and CTM Info Settle Response Message wil have a different PSAF value. Clients need to use information so there is no impact to settlement |

Investor CSD Features

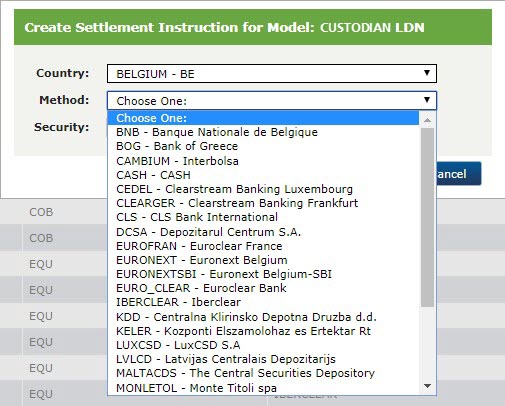

Traditionally, a depository could only be added under the ALERT Country Code if the selected depository is in the same country. ALERT now allows all T2S depositories to be added under each T2S country.

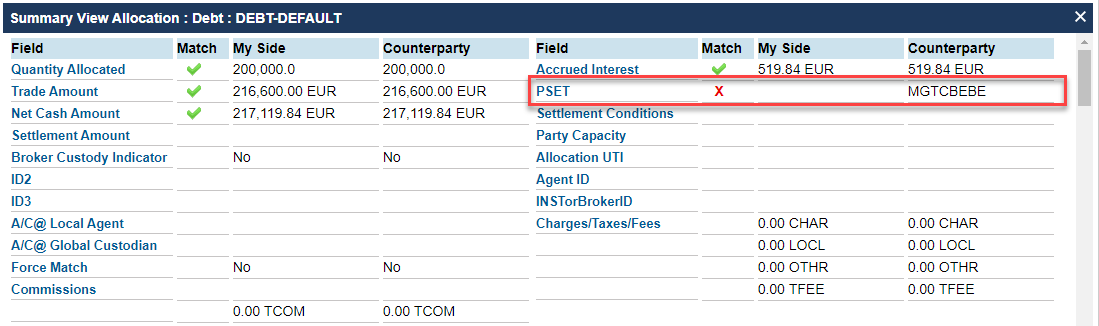

Place of Settlement (PSET) Matching provides CTM investment managers with the ability to compare the PSET BIC provided by their sell-side counterparty with their own PSET BIC for each of their allocations.

Where the BIC doesn't match, the allocation will be flagged with a status of mismatched (MISM) providing users with the opportunity to intervene and fix the matching issue before settlement.

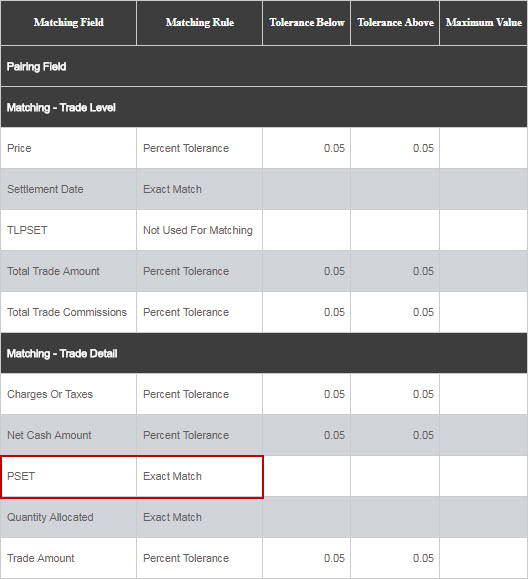

To switch on PSET matching, update your matching profile(s) to set the Trade Detail PSET field to EXCT (exact matching).

Step by step instructions on how to do this can be found in the How to Edit a Matching Profile video.

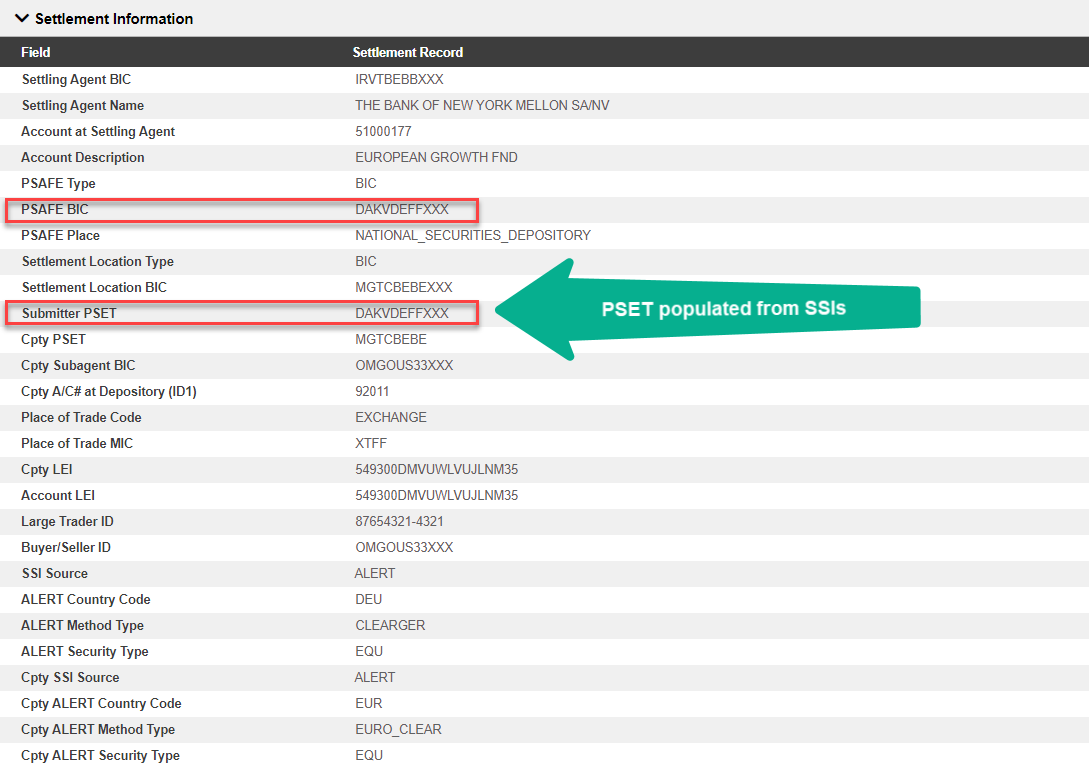

Buy-side CTM users can switch on the CBIC subscription for their organization. If this is enabled, CTM automatically copies the PSET BIC value to the PSAF field. We strongly recommend that users of the CTM Settlement Notification functionality do this. This functionality will also be available to sell-side clients at a later date.

If, once matching takes place, CTM identifies that the PSET and PSAF values are identical, it removes the PSAF value. Below is an example of the settlement information when the CBIC subscription is enabled, along with the corresponding tags as populated in the SWIFT message.

:94F::SAFE//NCDS/SICVFRPPXXX (94 is the PSAFE)

:95P::PSET/CIKBBEBBXXX (95P is the PSET)

To enable the CBIC subscription, your Product Administrator needs to submit a support request to add the CBIC subscription to your CTM organization. Submit a support request via MyDTCC.

In summary, to leverage all of the latest updates you should:

1. Set up SSIs based on any changes a Global Custodian may advise

2. Add PSET as an EXCT matching field (for Trade Detail matching) within your CTM matching profile(s)

3. Switch on the CBIC subscription for your CTM organization.