The ALERT Global Custodian Direct (GC Direct) workflow automates the exchange of standing settlement instructions (SSIs) between a custodian's central repository and the ALERT host using dedicated ISO 20022 compliant messages. This enhanced custodian/prime broker access enables the global custodian/prime broker to become the owner and maintainer of the SSI data, effectively creating the "golden copy" of SSI data within the ALERT platform.

This area of the Learning Center has been organized to provide general learning materials to support GC Direct (GCD), as well as specific learning materials that cater for the different client types that can be involved in the implementation of GCD - global custodians, investment managers and regional custodians or trustees.

For information on SSI management through the interface, select the Custodian SSI Management section under Related Content.

Parties Involved in the GCD Process

In the GCD workflow, the global custodian (GC) becomes the owner and maintainer of the SI data through a direct connection to the ALERT database.

This requires the GC to be set up up with an ALERT acronym to which the buy-side client links its account.

When the investment manager links their account (Access Code) to the GC as the SI Controller, the GC will submit SSIs for the account and the investment manager is notified of the new SSIs through an Alert message. From this point forward, the GC is responsible for updating and maintaining the SSIs for that account.

SSIs are then returned for all markets that the custodian has open and available in ALERT and are attached to the buy-sides' ALERT accounts. Any future updates to the SSIs flow directly to the buy-side's linked accounts.

For more on the Custodians and their capability to utilise GCD, review the ALERT GCD Global Custodian Capability Matrix within the Investment Manager section within this Parties Involved in the GCD Process overview.

For more on Regional Custodians and their capability to utilise GCD, review the ALERT GCD Regional Custodian Capability Matrix within the Regional Custodians section within this Parties Involved in the GCD Process overview.

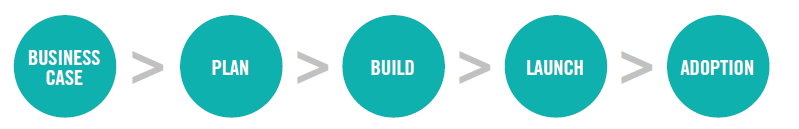

The ALERT Global Custodian Direct Adoption Playbook shares information and best practices around processes to build to the GC Direct workflow and helps custodians prepare for and successfully execute on the migration of the client community to this new workflow.

It has been organized into a client journey map that includes the below five phases - for each phase the context is set with overarching goals to be met and key activities to be performed, along with links to relevant resources to help execute against this plan.

| Resource | Tasks |

| Business/System Analysts | Map market-specific settlement instructions to/from ISO SSI standard message formats |

| Database Architects | Ensure the use of an efficient database structure |

| Developers | Build maps to/from the database to an xml schema and ensure a secure and controlled systemic process |

| MQ Administrators | Configure MQ connectivity |

Documents providing global custodians with detailed information on creating and receiving global custodian messages that flow between their system and the ALERT platform can be found underneath this section.

You should only attempt conversion to utilizing GCD SSIs in ALERT upon prior agreement with your custodian, therefore please reach out to your Global Custodian relationship management team to initiate the GCD adoption process. To learn more about which custodians are using the GCD and/or Regional Custodian workflows, please see ALERT GCD - Custodian Capability Matrix.

In the GCD workflow, the global custodian (GC) becomes the owner and maintainer of the SI data while the investment manager is the owner and maintainer of their own accounts and account-specific data. The investment manager places the responsibility of SSI maintenance and distribution with the GC. This model brings greater automation and efficiency to the process and reduces operational burden.

When the investment manager makes the GC the SI Controller, they must also supply their A/C# at Global Custodian so that when the GC submits the SSIs, this account number will be added. Once the GC-maintained SSIs are available on the account, the investment manager can:

1. Update the A/C# at Global Custodian

2. Add other account specific information which they own, such as Interested Party Data

The investment manager is also responsible for granting access to their brokers and maintaining this access. Notification of SSI data managed by GCD is performed in exactly the same manner as IM-managed data – through Alert notifications for additions, edits or deletions.

More detailed information on this process can be found in the ALERT GC Direct Onboarding Guide for Investment Managers and the video Understanding the GCD Conversion Process.

Additional information provided below includes the step by step details of the GCD conversion process, including steps that the investment manager can take in preparation for formally beginning the GCD conversion process with your GC.

For investment managers who are interested in converting their SSI maintenance to the GCD workflow, the below diagram outlines a check-list of activities that should be performed in preparation for the conversion process.

Before you begin conversions, ensure you have a letter of direction/authority in place with your custodian. DTCC has partnered with the custodian community to create a harmonized ALERT GCD Letter of Direction template for use by the community for GCD migrations. Please note, while most custodians will use this form as is, some may choose to use a modified version or leverage a custom form to accommodate any custodian organization preferences. Prior to onboarding, please check with your custodian, obtain the letter of direction, review, sign and return the form to your custodian. You should only attempt conversion in ALERT upon prior agreement with your custodian. An access code can only be linked to a single Global Custodian.

With regards to the first step in the pre-conversion process, below is further information on the data that needs to be reviewed and standardized.

- Review and compare your current ALERT SSIs to the Country-Security-Method combinations supported by your GC. For details on this, see the ALERT GCD Custodian Capability table further down this page.

- GCs maintain SSIs at the highest/common level security type (see the Security Type matrix, below). If a security type SSI shares the same SSI detail across multiple security types, the GC will maintain a single SSI. For example, most GCs store SSIs for Government Fixed Income under the ALERT security type for Treasuries (TRY). In this way, the security type of Treasuries will encompass NSD, MNB, ITS, GNM, FRM and AGS. This methodology is followed across each of the main security type groups - Equity, Corporate Bonds, Government Bonds, Money Market, FX/Cash.

- If SSIs are duplicate across security type groups and SSI detail is the same, investment managers can delete surplus SSIs leaving the highest/common security type SSI supported by their GC. This will streamline the pre-conversion reconciliation process and expedite migration to GCD managed SSIs.

- The UNIVERSAL method is not supported by any GC therefore any SSIs using this method will be migrated to the correct Country-Method combination during the GC conversion process. Investment managers should check if downstream internal systems are impacted by moving SSIs away from the UNIVERSAL method.

- Make a note of any Country-Security-Method combinations used by your GCD which differ to your existing instructions and check if downstream internal systems are impacted by this change. This should include reviewing your existing ALERT SSI enrichment process in CTM and making any required mapping changes to ensure that the correct Country-Security-Method combination is selected in the future.

- Some GCs may require investment managers to register for a TradeSuite Institution ID to support US SSIs in ALERT. To register for an Institution ID, complete and return this e-form using DocuSign.

You can also find more reference documentation related to SSI Maintenance from the Related Content links. Documents in this section, such as the ALERT SSI Maintenance Reference Guide, provides guidelines on a number of key data points that are helpful to consider when looking to migrate your accounts to the ALERT GCD workflow and to ensure that best practices are followed.

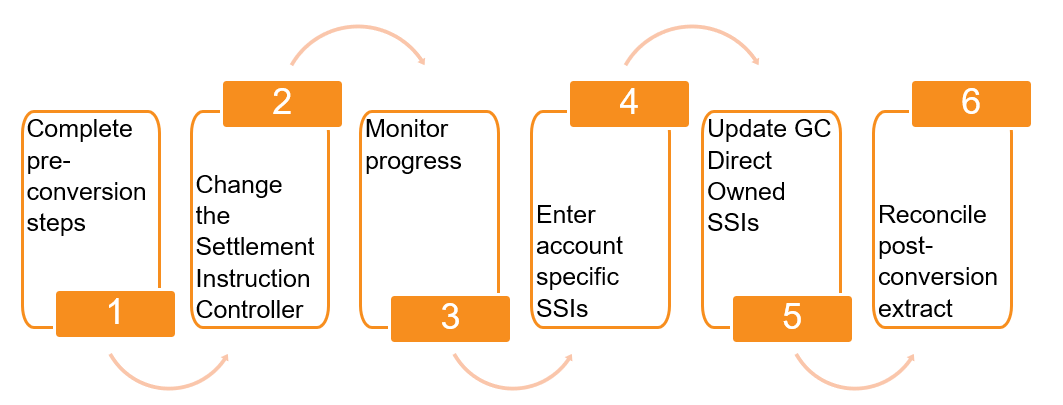

Below is an outline of the steps required to convert your accounts to a GCD model. More detailed information on how to perform each of these steps can be found in the ALERT: Understanding the Global Custodian Direct Conversion Process for Investment Managers video, at the beginning of this section.

1. Before you begin the conversion process and assign control of an account to your global custodian (GC), there are a number of pre-conversion steps to be completed. (See Pre-GCD Conversion Process for further details.)

2. You can change the SI Controller to the GC Direct (GCD) acronym, either manually or using ALERT Plus functionality. Once this step is complete, a conversion request will be sent to the GCD acronym enabling them to accept the request and provide corresponding SSIs for the account.

3. You can monitor the conversion status of your accounts from the GC Direct widget on the ALERT Home Page, indicating if the account is in one of the following statuses:

- In retrieval - the GC has not yet retrieved the conversion request

- Accepted - the GC has accepted the conversion request

- Rejected - the GC has rejected the conversion request

4. If there are any SSIs that your GCD does not support, you should add them as account specific instructions. These can either be added manually or using the ALERT Plus functionality.

5. Since the GCD owns the SSI, you cannot override any of the fields that they populate. However, you can add data to non-settlement fields e.g. Interested Party for DTC SSIs. This data can be added to the GCD-owned SSIs either manually or using the ALERT Plus functionality.

6. The final step in the conversion process is to compare your ALERT data post-conversion to the pre-conversion version. In order to do this you will need to use the Data Search-Utilities functionality to extract a report of your GCD-owned SSIs and compare this to the pre-conversion extract that you saved as part of the Pre-GCD Conversion Process.

If, upon comparison, the SSI detail for the more granular security type (not supported by the GCD) is different to the overarching security type (supported by the GCD), the more granular security type SSI will need to be retained. If there are no plans by the GCD to support the more granular security type, you can continue to manage these SSIs outside of the GCD flow.

| Security Type Groups | EQU | Corp FI | Govt FI | MM | FX/Cash | Unspecified |

| Main GCD Supported Security Types | EQU | COB | TRY | MMT | F/X | |

| Additional GCD Supported Security Types | GDR | CON | CSH | MSC | ||

| Securities supported in each Security Type Group | ADR | ABS (Asset Backed) | AGS (Agencies) | BAS (Bankers Acceptance) | CSH (Cash) | MSC (Misc.) |

| EQU | BKL (Bank Loan) | FRM (Freddie Mac) | CER (Representative Certificate) | F/X (Foreign Exchange) | OPC (Options Contract) | |

| GDR (Global Depository Receipt) | CMO | GNM (Ginnie Mae) | COD | MRG (Margin) | PRC (Premium Contract) | |

| PRS (Premium Shares) | COB (Corp Bond) | ITS (Indexed Treas Sec) | COM (Commercial Paper) | TBA (To Be Announced) | PRP (Priv Place) | |

| RTS (Rights) | CON (Convertible Bond) | MNB (Muni Bond) | FIN (Finance Transaction) | TIM (Time Deposit) | REP (Repurchase) | |

| CPN (Coupons) | NSD (Non US Sovereign Debt) | MMT (Money Market) | TRS (Trans Ship) | |||

| FPA (Face or Principal or Nominal Amount) | TRY (Treasuries) | REP (Repo) | ||||

| ILB (Inflation Linked Bonds) | ||||||

| MBS (Mortgage Backed) | ||||||

| NTE (Notes) | ||||||

| SLA (Student Loan) |

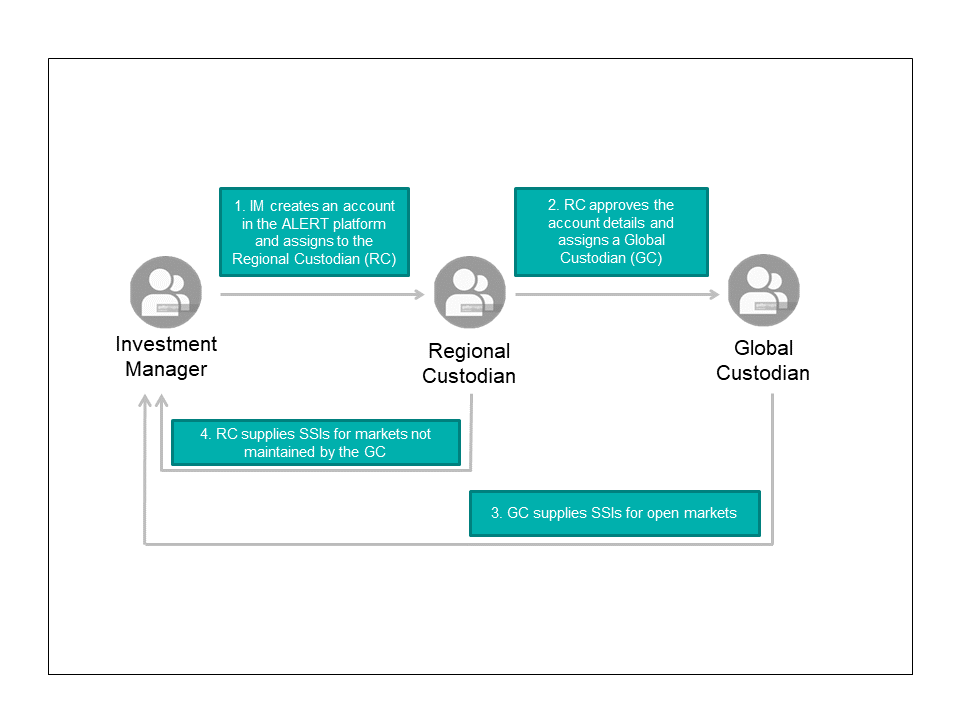

Regional Custodians/Trustees own the custody relationship with investment managers. They manage local SSIs while leveraging a global custodian's network to access global markets. As a result, investment managers do not have a direct relationship with the global custodian for these accounts.

In this workflow, the investment manager assigns its account to the regional custodian who in turn assigns the account to the global custodian. The global custodian supplies SSIs for open markets and the regional custodian supplies SSIs for markets not maintained by the global custodian.

When the investment manager assigns their account to the regional custodian, the regional custodian receives an Alert message which they must approve. Following approval the regional custodian then assigns the account to the global custodian, using the SI Controller field to identify the GCD acronym.

Detailed documentation that outline this workflow and the specific requirements for implementation can be found below:

ALERT GC Direct Onboarding Guide for Trustees

ALERT GC Direct Onboarding Guide for Regional Custodians

General GCD Technical Documentation

ALERT GC Direct 1.1 Interface XSD File

ALERT GC Direct Adoption Playbook

ALERT GC Direct Letter of Direction

ALERT Future Effective Settlement Instruction Controller (SIC): Implementation Guide