Welcome to the Custody Service section of this Learning Center. DTC's Custody Service enables participants to outsource the safekeeping and processing of physical securities that are not or cannot be held through DTC’s core depository services. You can outsource all or part of your physical securities inventory for safekeeping.

When Regular Custody Services are used in conjunction with DTC's Branch Deposit Service (BDS), Restricted Deposit Service (RDS), and New York Window (NYW) Service, Custody participants are able to retain control of their securities without having to handle and secure them.

The Custody Service allows you to deposit securities not traditionally eligible for DTC, including securities such as customer-registered custodial assets, restricted shares, and certain DTC-ineligible securities such as certificated money market instruments (MMIs), private placements, and limited partnerships.

Expand and read the sections below, then login to access Related Content and learn more about the Custody Service and Custody Eligibility.

The Custody service takes multiple steps to ensure that your assets are safely stored and accounted for. As a result, customers of the service enjoy many benefits, including:

The Custody service takes multiple steps to ensure that your assets are safely stored and accounted for. As a result, customers of the service enjoy many benefits, including:

- Storage of assets in DTC secure vault.

- Total system reliability, as provided by DTC.

- An annual audit of inventory, ensuring the reliability of its contents.

- Assigning of unique reference numbers to all deposits.

- Imaging of all certificates and documents that pass through the Custody service, creating records that can outlive the physical certificates.

- Availability of images via DTC’s Imaging, Fax, and E-mail (IFE) system, as well as the Image Drop-Box solution.

- Easy communication with DTC’s Custody service via the Participant Browser System, the Computer-to-Computer Facility (CCF), and MQ.

- Availability of end-of-day positions and activity reports.

- Reduction of vault space, equipment, and maintenance expenses on your part.

- Reduction of your insurance costs associated with the safekeeping and physical movement of securities.

DTC intends to make all appropriate securities eligible for its Custody Service. DTC reserves the right, in its sole discretion to refuse to accept a security or other asset for its Custody Service.

DTC intends to make all appropriate securities eligible for its Custody Service. DTC reserves the right, in its sole discretion to refuse to accept a security or other asset for its Custody Service.

Note: DTC compares certificate information with the deposit instruction transmitted by the depositing Participant in the “deposit expectancy file”.

Anything that can be securitized is eligible for custody including, but not limited to:

- Stocks (negotiable, non-negotiable and restricted)

- Bonds

- Open-ended mutual funds, short-term money market instruments, foreign securities, interest only, limited partnerships, promissory notes, private placements, customer-registered custodial assets.

- Gold/Silver certificates

Note: DTC Custody will hold certain “non-standard” type assets fully disclosed for safekeeping only. These assets include, but are not limited to, Option Agreements and Warrant to Purchase. DTC does not accept any liability should such assets be lost, stolen or destroyed. Depositing Participants assume full liability as well as responsibility for replacement of lost, stolen or destroyed fully disclosed “non-standard” assets.

Financial items/documents that are not eligible for the Custody service include:

Financial items/documents that are not eligible for the Custody service include:

- Currency

- Wills, deeds, insurance

- Policies, Mortgage papers

- Terminal output of stock

- Record positions

- Tickets/Vouchers for airline

- Permanent loan certificates

- IRA Statements

- Annuities/Tax Returns

- Interest only

- Bills of sale

- Bank account applications

- Liquidity Letters of Credit

- Legal correspondence on clients assets

- Contracts of prevailing wage certificates

- Legal correspondence on clients assets

- Assignment of real estate

Safekeeping

DTC’s Regular Custody Services free you from the cumbersome physical handling of those securities that are not traditionally eligible for DTC processing.

- Processing withdrawals from inventory, which can include mailing to your customers or branches

- Mailing of certificates as instructed

- Production of customized letters

- Systemic account number changes

- Coupon clipping and shell presentation

- Trailing document deposit

- Customer request for audits

To learn more be sure to login and view the videos in the Custody Safekeeping section.

Transfers

DTC’s Custody Service allows you to submit transfer instructions requesting re-registration into firm or customer name. It also allows for breakdown requests.

Restricted Transfers

Restricted deposits and their transfer instructions are hand delivered or sent by FedEx Priority Overnight service to the transfer agent.

Custody Reorganization

The Custody Reorganization Service allows for presentations on corporate events not eligible for regular DTC services and/or DTC eligible corporate events in restricted shares.

- Assistance with research into reorganization and redemption activities

- Follow-up until all proceeds have been collected

- Allocation of both cash and stock proceeds

- Option of designated custody boxes for reorg sweeps

Branch Deposit Service (BDS)

The Branch Deposit Service (BDS) allows you to have your customer deposits sent directly to DTC from their branches and/or correspondents. The BDS service performs a full examination of these securities prior to crediting into your free account.

- Less workspace and vault space required

- Reduce deposit cycle time

- Mitigate risk

New York Window/Physical Settlement

The New York Window (NYW) allows customers to effect both over-the-window and NSCC & ESS transactions. Customers can effect deliveries using inventory from their custody vault.

To learn more be sure to login and visit the New York Window section.

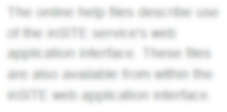

Restricted deposits and their transfer instructions are hand-delivered or sent by FedEx Priority Overnight service to the transfer agent. The following figure shows the general process flow of items through the Restricted Deposits service.

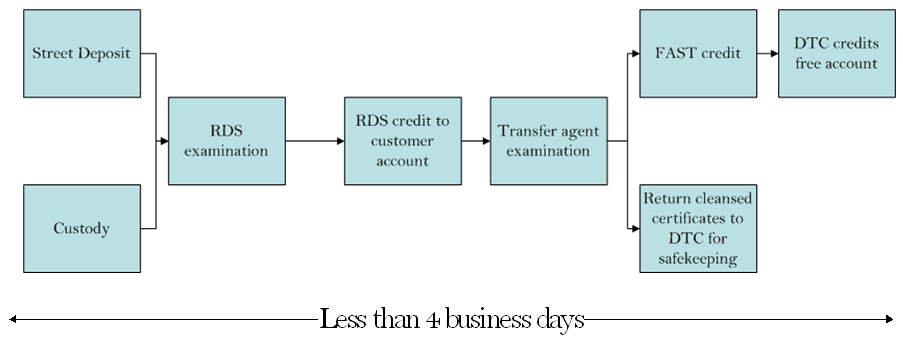

The following figure provides a more detailed view of the movement of items through the service.

The Custody Reorganization Service allows for presentations on corporate events not eligible for regular DTC services and/or DTC eligible corporate events in restricted shares.

The service provides you with:

- Assistance with research into reorganization and redemption activities

- Follow-up until all proceeds have been collected

- Allocation of both cash and stock proceeds

- The option of designated custody boxes for reorg sweeps.

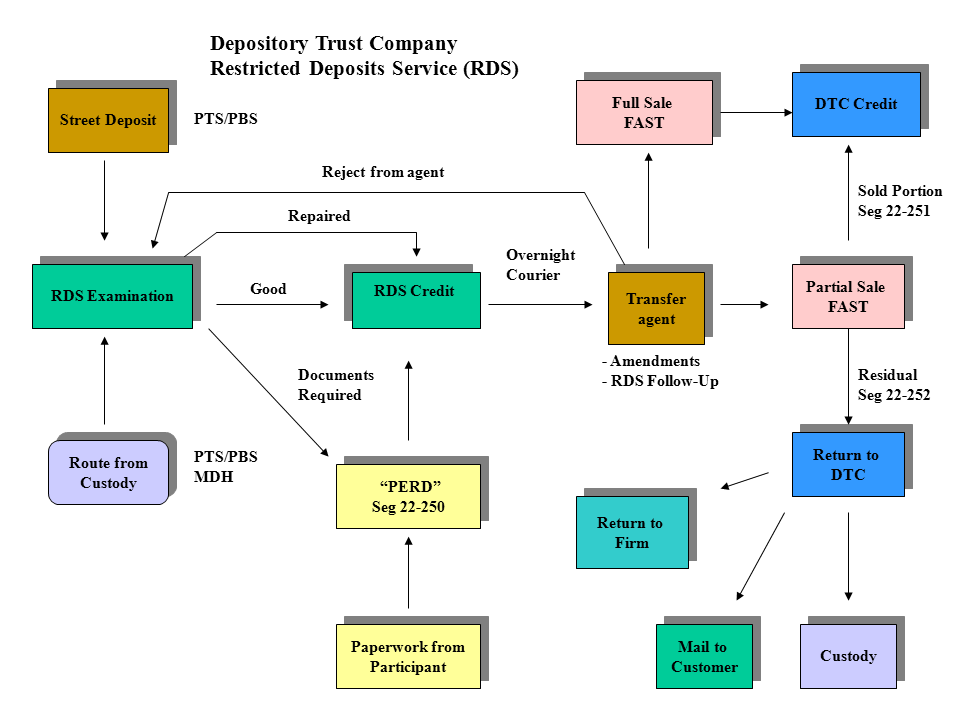

The following image shows the custody reorganization flow:

Custody Conversion Checklist

Custody Service - FAQs