CTM, along with other ITP products, supports a variety of asset classes. A full list of supported instrument types can be found in the ITP Asset Class Coverage document. The majority of the content in the CTM area of the DTCC Learning Center references the generic workflow and matching process used for equity and debt trades.

To support different asset classes, variations in the workflow and matching process are sometimes required. Information specific to these asset classes can be found below.

Fixed Income

CTM supports the matching of a number of different fixed income instrument types. Whilst the message interface specifications for fixed income trades are the same as those used for equity trades, the CTM: Fixed Income: Best Practices provides recommended best practices for different types of fixed income instruments, required data elements for those instruments and any market-specific requirements.

To Be Announced (TBA) Mortgage-Backed Securities

For most fixed income products, clients typically match on accrued interest and net amount on both the block and allocation. This information typically isn't available for TBAs and therefore many brokers allege TBAs without accrued interest, while investment managers do allege accrued interest which could result in a mismatch (MISM) status.

To handle this situation there are number of best practices that are recommended to successfully match TBA transactions. Please review the content below for further details:

TBAs can be submitted, amended and viewed through all available CTM interfaces, including Direct XML, FIX, MTI and the CTM User Interfaces (UIs). Specific information on message formats can be found below:

Investment managers and broker/dealers submit TBAs in the TradeLevelInformation composite of the TradeLevel or TradeDetail message. The bold values in the following partial TradeLevel show where you designate a TBA trade and the stipulations for that trade.

...

<TradeLevelInformation>

<TypeOfTransactionIndicator>TRAD</TypeOfTransactionIndicator>

<BuySellIndicator>SELL</BuySellIndicator>

<TypeOfFinancialInstrument>TBAN</TypeOfFinancialInstrument>

<DealPrice>

<CurrencyCode>USD</CurrencyCode>

<Amount>204,</Amount>

</DealPrice>

...

<StipulationsStandard>

<StipulationCodeStandard>ARMCAP</StipulationCodeStandard>

<StipulationValueStandard>

<StipulationNumeric>10,0</StipulationNumeric>

</StipulationValueStandard>

</StipulationsStandard>

<StipulationsStandard>

<StipulationCodeStandard>INTONLY1020</StipulationCodeStandard>

<StipulationValueStandard>

<StipulationYOrN>Y</StipulationYOrN>

</StipulationValueStandard>

</StipulationsStandard>

<StipulationsNonStandard>

<StipulationCodeNonStandard>NSTYPE</StipulationCodeNonStandard>

<StipulationValueNonStandard>2</StipulationValueNonStandard>

</StipulationsNonStandard>

...

For more information about submitting TBAs using the Direct XML Interface, see Chapter 3. Trade Messages in the CTM: XML Message Specification: Debt and Equity document.

Investment managers submit TBAs in the Allocation Instruction (J) message.

Allocation Instruction (J)

The bold values in the following partial J message example show where you designate a TBA trade and its stipuations.

70=test0207|71=0|626=1|857=0|54=1|48=GB00B00NY175|22=4|167=TBA|541=20411207|225=

5223=4.75|107=UNITED KINGDOM GILT 4.75 12/07/2038 DTD 04/23/2015 GILT|53=5000000|6=

106.86|15=GBP|...|232=3|233=ARMCAP|234=10,0|35588=S|233=INTONLY2020|

234=Y|35588=S|22=NSTYPE|234=2|35588=N|...

Allocation Report (AS) - Settlement View

The bold values in the following partial message example show where the CTM service returns the TBAN value and the stipulations.

8=FIX.4.4|9=5968|35=AS|34=416|49=OMGEOCTM|56=FFTW|52=20111117-21:11:11|453=2|

448=FXQITTA1XXX|447=B|452=13|448=FXQITTA2XXX|447=B|452=1|71=0|794=3|

775=FFTWTCTMZZZ1133993786183|87=0|9053=Y|...232=3|233=ARMCAP|234=10,0|3588=S|

233=INTONLY1020|234=Y|35588=S|233=NSTYPE|234=2|35588=N|...

There are a number of subscriptions available to facilitate the processing/matching of TBAs, and the ability to view associated stipulations:

| Subscription Code | Subscription Description | Intended Organization Type | Comment |

| BMTS* | Bypass L2 Matching for TBA Securities | Investment managers | Controls whether CTM will retrieve the TBAN-DEFAULT profile (Y-Yes) if the investment manager has created one |

| STIP | Stipulations | Investment managers; broker/dealers | Allows you to receive your counterparty's TBA stipulations in the InfoResponse and InfoSettlementResponse messages; both parties to the trade are required to have this subscription |

| TBAP | TBA Processing | Investment managers |

Controls the return of the following fields on the outbound InfoSettlementResponse message and reflects the investment manager's values instead of their counterparty's values:

|

* The use of this subscription impacts the subsequent workflow depending on whether the broker is a USDI broker:

For trades with non-USDI brokers: if the BMTS subscription option is set to Y (Yes), the trade has a TypeOfFinancialInstrument of TBAN, and the broker is not a USDI broker, CTM automatically invokes the use of the TBAN-DEFAULT matching profile

For trades with USDI brokers: if both the BMTS and USMP (USDI Matching Profile) subscription options are set to Y (Yes), and the broker is also subscribed to USDI, the investment manager can create a USDI specific matching profile for TBA securities and CTM will automatically invoke the use of the USDI-TBAN-DEFAULT profile.

Also note the following:

- The TBA match profile is invoked if the Type of Financial Instrument (TOFI)=TBAN or the investment manager's Security Type=CUSIP and the investment manager's Security Code starts with 01F, 01N, 02R or 21H, or the investment manager's Security Type=ISIN and the investment manager's Security Code starts with US01F, US01N, US02R, or US21H.

Investment managers should use a named matching profile using the naming convention of TBAN-DEFAULT.

As a best practice, NetCashAmount or AccruedInterest should not be included as matching criteria.

The CTM UI 4.0 can be used to manually enter, view and amend TBA trades including stipulations.

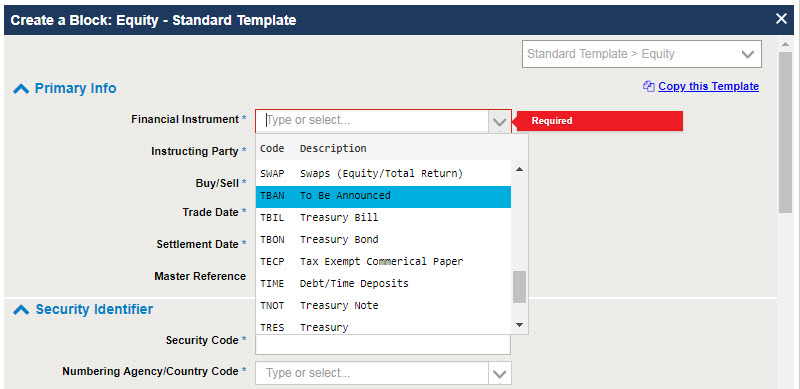

Both counterparties to the trade have to provide a value of TBAN in the Type Of Financial Instrument field. The below screen shows where to supply TBAN in the Create a Block screen.

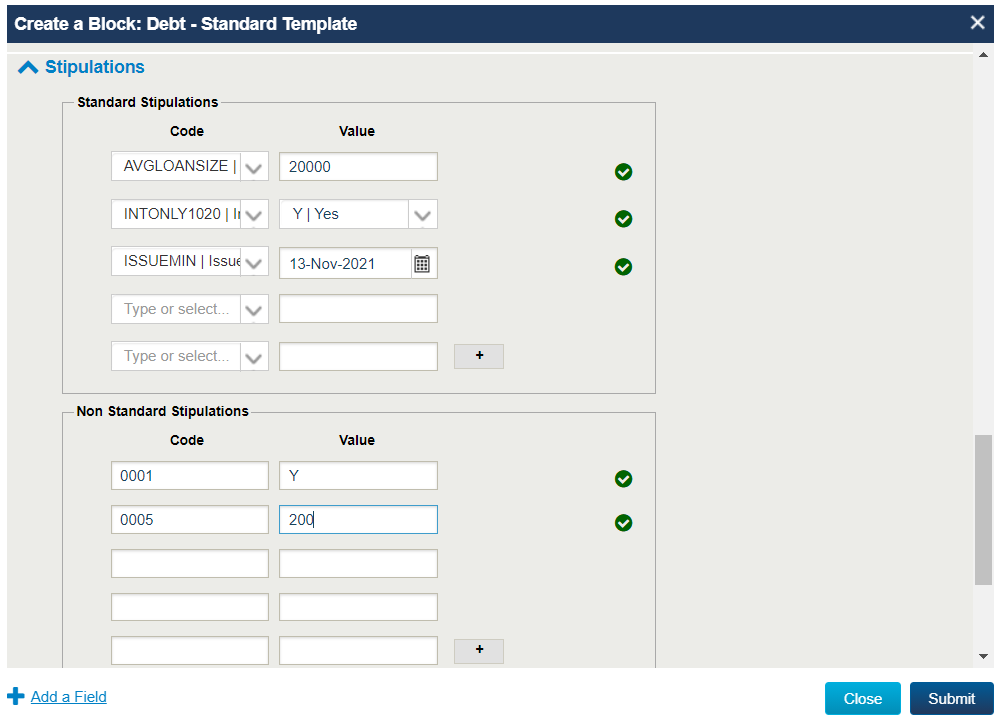

Both counterparties to the trade can enter up to 20 standard and 20 non-standard stipulations on TBA trades. The below screen shows a number of stipulations populated in the Create a Block screen. The +/- button can be used to add and remove stipulations.

Note: the Stipulations fields are not included as part of the Standard Template therefore you will first have to use the Add a Field feature to add these on either a trade-by-trade basis or to a custom template that you create for your TBA trades.

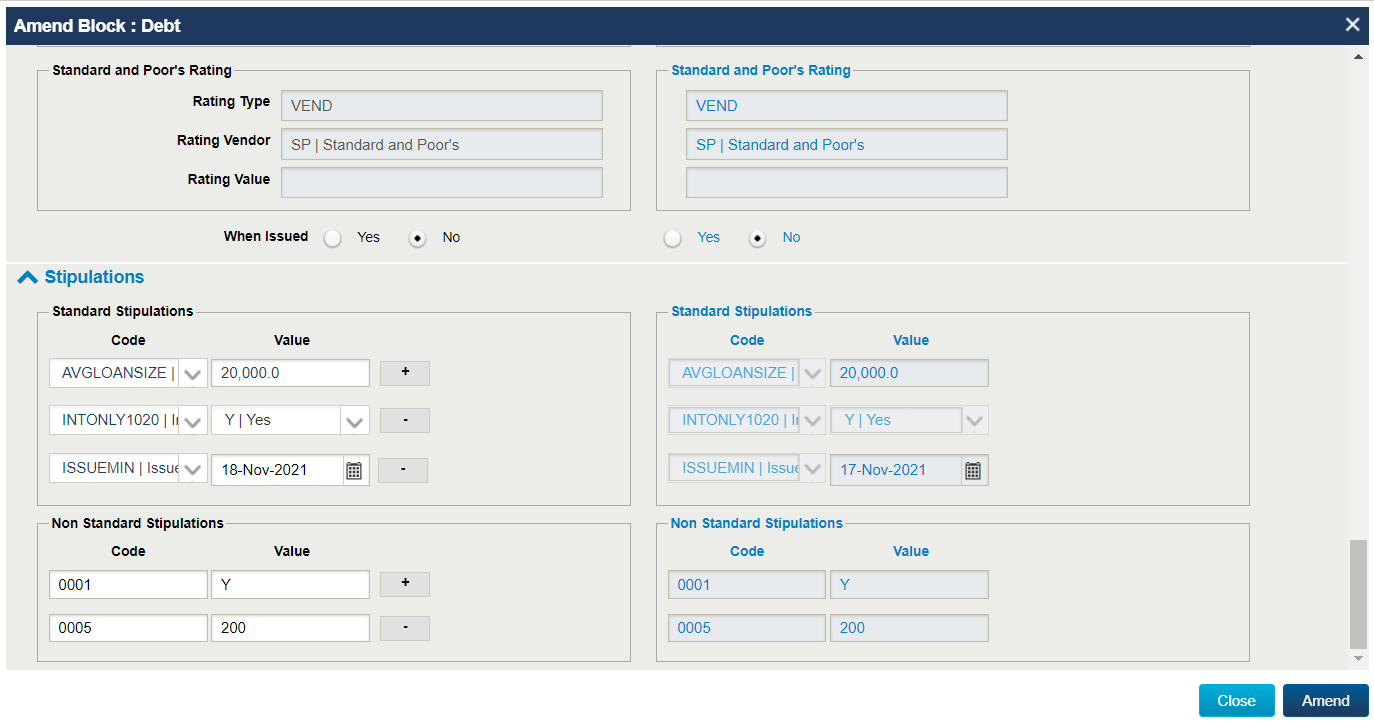

Both counterparties to the trade can view and amend stipulations on their TBA trades. To view the stipulations, select a trade and the Summary View option. To amend the stipulations, select a trade and then Amend Trade. The Amend screen is displayed, showing both My Side and Counterparty Side details. You can edit any of the details, including the stipulations on My Side and then click Amend to save your changes.

Certificates of Deposit / Commerical Papers

CTM supports the matching of certificates of deposit and commercial papers and considers these as debt instruments (fixed income). Please review the content below for further details about how to submit and match CD/commercial paper trades.

CDs and commercial papers can be submitted, amended and viewed through all CTM interfaces, including Direct XML, FIX, MTI and the CTM User Interfaces (UIs). Specific information on message formats can be found below:

Investment managers and broker/dealers submit CDEP or CPAP in the TradeLevelInformation composite of the TradeLevel and TradeDetail message. The bold value in the following partial TradeLevel shows where, as an example, you designate a CD.

...<TradeLevelInformation>

<TypeOfTransactionIndicator>TRAD</TypeOfTransactionIndicator>

<BuySellIndicator>SELL</BuySellIndicator>

<TypeOfFinancialInstrument>CDEP</TypeOfFinancialInstrument>

<DealPrice>

<CurrencyCode>USD</CurrencyCode>

<Amount>204,</Amount>

<DealPrice>...

There are no additional subscriptions required to submit, amend or view CD/commercial paper trades.

As CDs/commercial papers are considered to be debt instruments by CTM, the default DEBT matching profile will be applied to your CD/commercial paper trades for matching, unless you decide you want to apply a specific named matching profile. In this scenario you will have to be confident that your OMS is capable of identifying the correct named matching profile to be applied to your trade.

The CTM UI 4.0 can be used to manually enter CD/commercial paper trades.

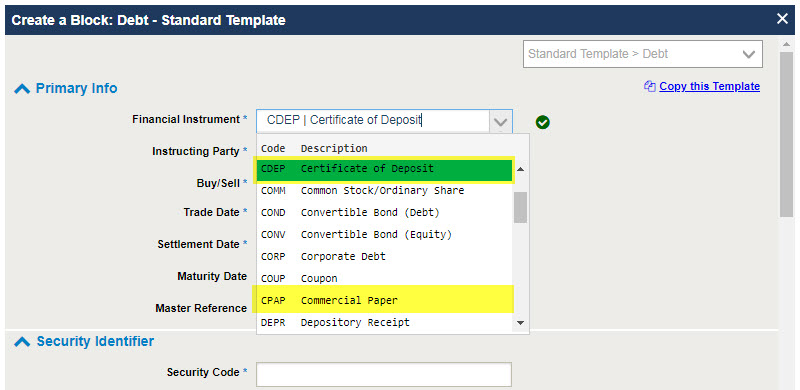

Both counterparties to the trade have to provide a value of CDEP or CPAP in the Type of Financial Instrument field. The below screen shows where to supply this information in the Create a Block screen.

Repurchase Ageements (Repos)

CTM supports the matching of the following types of repurchase agreements (repos) for both investment managers and brokers:

- Buy/sell-back repos

- Bilateral repos

Whilst CTM applies a similar central matching process for repos as it does for equity/debt trades, there are specific requirements for the submission and matching of repo trades. Further detailed information can be found in the CTM: Asset Class Overview: Repurchase Agreements (Repos) as well as below.

Repo trades can be submitted, amended and viewed using the Direct XML and MTI message interfaces, as well as using the CTM UI 3.0 (Trade Blotter). Comprehensive documentation for each of these interfaces can be found below:

CTM XML Message Specification for Repurchase Agreements (Repos)

CTM XML DTDs for Repurchase Agreements (Repos)

CTM MTI Specification: Repurchase Agreements (Repos)

To enable you to conform with dual-sided unique transaction identifier (UTI) regulatory requirements, CTM can automatically generate the BlockUTI, BlockUTISource, AllocationUTI and AllocationUTISource fields on your behalf. This functionality is enabled through a number of subscription options:

| Subscription Code | Subscription Description | Intended Organization Type | Comment |

| RAUS | Auto Generate Repo UTIs | Investment manager; broker/dealers |

Required for CTM to auto-generate UTIs. At least one party in a trade must be subscribed for the auto-generation of UTIs. If you want CTM to automatically generate UTIs, this subscription option should be set to Y - Yes. |

| RUTI | View Unique Trade Identifier for Repurchase Agreements | For orgs that are subscribed to RAUS |

Enables CTM to return the BlockUTI and the AllocationUTI fields on the following response messages from CTM when the organization is also subscribed to RAUS:

If you do not want to return the UTIs on your messages, then set this subscription option to N - No. |

| RUSI | Return Repo UTI Source Indicators | Investment manager; broker/dealers |

Enables CTM to return both UTI Source fields on the following response messages from CTM when the organization is also subscribed to RAUS:

Recommended for all CTM clients. If you want to return both UTI Source fields on your messages, then set this subscription option to Y - Yes. |

Further details on how CTM generates the UTI for repo trades can be found in the CTM: Asset Class Overview: Repurchase Agreements (Repos).

The matching process for repos follows the same 2-level matching process to match both block (TradeLevel) and allocation (TradeDetail) messages as used in the standard workflow, with a few key differences.

- Investment managers use matching profiles to decide on the criteria and tolerances to be used when matching. As a minimum requirement, they must setup a REPO-DEFAULT profile which can be applied to all repo trades. In addition they can set up currency specific repo matching profiles (e.g. REPO-EUR) or use a named profile.

- CTM uses a different set of L1 pairing fields for repo trades. The below table lists the L1 pairing fields on blocks and allocations and whether these fields are mandatory or optional.

| Field Name | Mandatory/Optional | Further Information |

| Block (TradeLevel) | ||

| Block UTI | Optional | |

| Buy/Sell Indicator | Mandatory | CTM requires cross-matching. There are two valid values for the BuySellIndicator: BUYI and SELL. CTM successfully pairs this element when one party provide BUYI and the other party provides SELL |

| Deal Price | Optional | |

| Executing Broker | Mandatory | |

| Instructing Party | Mandatory | |

| Open Leg Cash Amount | Mandatory | CTM uses this field as a tie-breaker for L1 pairing on the block. |

| Open Leg Collateral Quantity/Amount | Mandatory | |

| Open Leg Settlement Date | Mandatory | |

| Security Code | Mandatory | Security Code is a normalized value. CTM cross-references and pairs it with the preferred identifier of your counterparty. Even if the identifiers are different, CTM pairs and matches on values you and your counterparty supply. |

| Trade Date and Time | Mandatory | |

| Allocation (TradeDetail) | ||

| Account ID | Mandatory | |

| Open Leg Collateral Quantity Allocated/Amount | Conditional | CTM users this field as a tie-breaker for L1 pairing on the allocation. |

Detailed information on the matching process can be found in Chapter 2 of the CTM: Asset Class Overview: Repurchase Agreements (Repos).

Full exception processing functionality for repo trades is available in the CTM UI 3.0 (Trade Blotter).