Mortgage-Backed Securities Division

Folder Mortgage-Backed Securities Division

MBSD's mission is to reduce the costs and risks associated with trading in the agency mortgage-backed securities market. To accomplish this mission, MBSD provides high-quality and value-added services that are driven by the needs of its members and industry participants.

Categories

Folder Electronic Pool Notification

The Electronic Pool Notification section defines EPN, explains how to access the systems required to use it, explains how to find and use its reports, and provides technical information for its use.

Folder MBSD Cash Settlement

Cash Settlement is a daily automated process of settling cash credit and debit amounts between members and FICC. To provide this service, FICC employs the Federal Reserve Bank’s National Settlement Service (NSS) to debit and credit net settlement obligations at the settling bank level of MBSD members.

Folder MBSD Reports

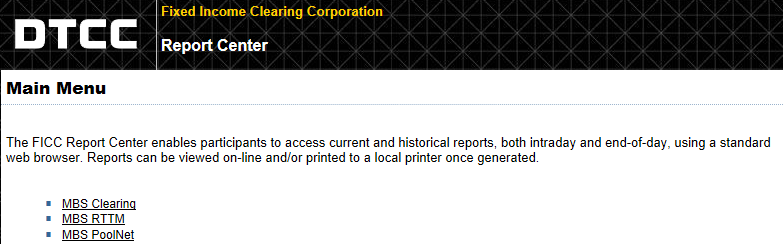

When viewing MBSD Report Center, several links or menus can be seen: MBS Clearing, MBS RTTM, and MBS PoolNet. To help our clients better understand the reports produced in these categories, we have created several report guides which explain the purpose of each report, the formats in which it is available, its report headers and its data elements. For each of the menus in MBSD Report Center, there is an associated guide. In addition, the MBSD Operational Novation Reports Guide specifically details the reports most relevant to MBSD Novation.

MBSD Report Center Main Menu

Folder MBSD Risk Management

Risk management is the foundation for MBSD’s ability to guarantee settlement, as well as the means by which MBSD protects itself and its Members from the risks inherent in the settlement process, including the possibility of a Member default.

Folder MBSD RTTM

Real-Time Trade Matching (RTTM®) enables dealers, brokers and other market participants to automate the processing of fixed income securities trades throughout the trading day.

The MBSD RTTM® system provides access to users who are looking to perform MBS processing for Trade Matching, TBA Netting, Do-Not-Allocate, Pool Netting, and Clearance tasks activities.

The Real-Time Trade Matching System (RTTM) for Mortgage-Backed Securities (MBS) is a product of the Fixed Income Clearing Corporation's Mortgage-Backed Securities Division (MBSD). RTTM is a trade-entry/management tool that increases the efficiency of trade operations yet reduces your firm’s overall risk. All activity is validated and matched in real-time. From trade submission to comparison, processing time is reduced to a fraction of what it had taken in the past.

Note:

Many of the screens and processes in the below sections refer to the previous RTTM system. These materials have been left on the Learning Center as most of the workflow has remained the same. New training assets will be rolled out over time to replace the dated reference material.