View Your ITP Data Analytics T+1 Scorecard

The T+1 Scorecard displays your CTM® matching and TradeSuite ID® affirmation rates and timings and compares them to recommended cut-off times and current industry averages. Use this data to prepare your firm for future T+1 settlement in May 2024 for the US market.

Depending on your firm and roles, you may not have access to all selections.

Your firm and user roles determine which CTM BIC(s) and/or TradeSuite ID(s) you have access to.

Click the icons to expand, collapse, and print the content on this page.

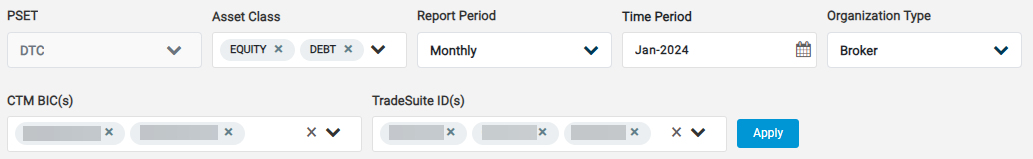

The T+1 Scorecard displays the current filter selections at the top of the page.

Alter the selections to display new results using the following guidelines:

- PSET: Currently fixed to DTC for the US market. It looks at the PSET value as populated by the Broker at the block level.

- Asset Class: By default, ITP Data Analytics includes both Equity and Debt. To remove one, click x.

- Report Period: Select between a Weekly and Monthly report.

- Time Period: Depending on your Report Period, select a date or month from the drop-down calendar. If you chose weekly, ITP Data Analytics generates a report from the preceding Saturday to the following Friday. ITP Data Analytics contains data beginning June 2023.

- Organization Type: Select between Broker and Institution if your organization acts as both.

- CTM BIC(s): Lists the BICs you have permission to access. To remove any from the scorecard, click x.

- TradeSuite ID(s): Lists the IDs you have permission to access. To remove any from the scorecard, click x.

- Apply: Click Apply to refresh the data. If the selected filters return no data, ITP Data Analytics displays an error message.

The T+1 Scorecard shows the result of your filter selections. Edit the filters and click Apply to display new results.

All metrics are based on trades where PSET=DTCYUS33, and all references to a time are in Eastern Time (United States).

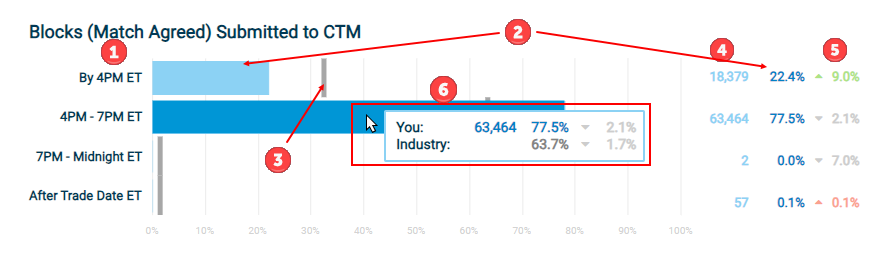

For all metrics displayed with a bar chart, use the following guidelines:

|

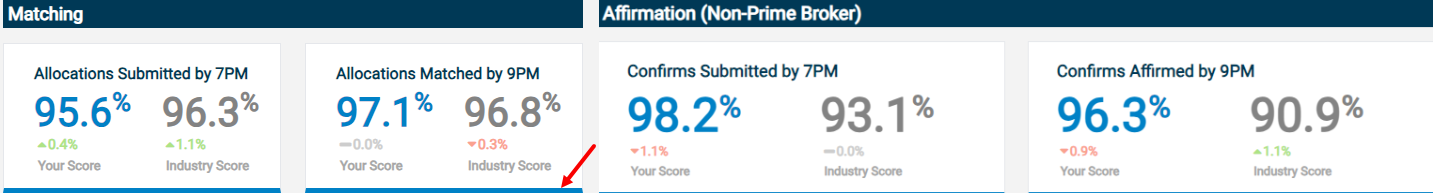

These metrics show an overview of your operational performance, measuring the timeliness and accuracy of matching in CTM and the timeliness of confirm and affirmation in TradeSuite ID.

| Metric | Definition |

|---|---|

| Allocations Submitted by 7 PM | Percentage of allocations submitted to CTM by 7:00 PM on trade date, regardless of their Match Agreed status. Total allocations submitted by 7:00 PM / Total allocations submitted for the time period |

| Allocations Matched by 9 PM | Percentage of allocations with their blocks in Match Agreed (MAGR) status in CTM by 9:00 PM on trade date, excluding trades in Cancel Match Agreed (CMAG) status. Total allocations in MACH by 9:00 PM / Total allocations submitted for the time period |

| Confirms Submitted by 7 PM | Percentage of DTC eligible confirms submitted to TradeSuite ID by 7:00 PM on trade date, excluding canceled confirms. For institutions, this excludes prime broker confirms. Total eligible confirms submitted by 7:00 PM / Total eligible confirms submitted for the time period |

| Confirms Affirmed by 9 PM | Percentage of DTC eligible confirms affirmed in TradeSuite ID by 9:00 PM on trade date, excluding canceled confirms. For institutions, this excludes prime broker confirms. Total eligible confirms affirmed by 9:00 PM / Total eligible confirms submitted for the time period |

| Your Score | Your average based on the selected CTM BIC(s) or TradeSuite ID(s) |

| Industry Score | Depending on your organization, average for all investment managers or brokers for the selected asset classes and time period. If you are an investment manager, this is the average for all investment managers. If you are a broker, this is the average for all brokers |

| Percentage Difference | Indicates how much the score changed compared to the previous month with a directional, color-coded indicator |

These metrics measure the timeliness and accuracy of matching in CTM.

Blocks and Allocations/Confirms

Use the toggle to specify whether to show Block or Allocations/Confirmations metrics for the selected filters.

Block Submission Breakdown

| Metric | Definition |

|---|---|

| Block (Match Agreed) Submitted to CTM | Number of blocks in Match Agreed (MAGR) status your associated BIC(s) submitted to CTM, and what percent of them were submitted within each time frame |

| Block (Not Match Agreed) Submitted to CTM | Number of blocks in Not Match Agreed (MAGR) status your associated BIC(s) submitted to CTM, and what percent of them were submitted within each time frame |

Block Totals

| Metric | Definition |

|---|---|

| Total Block Volume | Total number of blocks submitted to CTM, broken down by their trade side match agreed statuses |

| Touches | Number of blocks your associated BIC(s) rebooked, amended, or force matched. If a block is touched multiple times, it counts as one touch |

These metrics represent allocations for instructing parties and confirms for brokers.

Allocation/Confirm Submission Breakdown

| Metric | Definition |

|---|---|

| Allocations/Confirms (Match Agreed) Submitted to CTM | Number of allocations/confirms within blocks in Match Agreed (MAGR) status your associated BIC(s) submitted to CTM, and what percent of them were submitted within each time frame |

| Allocations/Confirms (Not Match Agreed) Submitted to CTM | Number of allocations/confirms within blocks in Not Match Agreed (NMAG) status your associated BIC(s) submitted to CTM, and what percent of them were submitted within each time frame |

Allocation/Confirm Matching Breakdown

| Metric | Definition |

|---|---|

| Confirms Matched & Auto-Affirmed in CTM | Number of allocations/confirms within blocks that reached Match Agreed (MAGR) status through the M2i (USDI) workflow, and what percent of them were matched within each time frame |

| Confirms Matched & Not Auto-Affirmed in CTM | Number of allocations/confirms within blocks that reached Match Agreed (MAGR) status through a non-M2i (USDI) workflow, and what percent of them were matched within each time frame |

Allocation/Confirm Totals

| Metric | Definition |

|---|---|

| Total Allocation/Confirm Volume | Total number of allocations submitted to CTM, broken down by their trade side match agreed statuses |

| Touches | Number of allocations/confirms your associated BIC(s) rebooked, amended, or force matched. If one block is touched multiple times, it only counts once |

These metrics measure the timeliness of the confirm and affirmation process in TradeSuite ID.

Non-Prime Broker Confirm Submission Breakdown

| Metric | Definition |

|---|---|

| Total Institutional Confirm Volume | Number of institutional confirms submitted to TradeSuite ID, broken down by whether they were Affirmed, Unaffirmed, or Cancelled |

| Institutional Confirms Submitted by Broker Directly to TradeSuite ID | Number of institutional confirms the broker submitted to TradeSuite ID, and what percent of them were submitted in each time frame |

| Institutional Confirms Submitted by CTM to TradeSuite ID | Number of institutional confirms CTM submitted to TradeSuite ID, and what percent of them were submitted in each time frame |

Non-Prime Broker Confirm Affirmation Breakdown

If your Organization Type is Broker, Institutional Confirms Auto-Affirmed is labeled Institutional Confirms Auto-Affirmed in CTM.

| Metric | Definition |

|---|---|

| Institutional Confirms Auto-Affirmed | Number of institutional confirms auto-affirmed in CTM via the USDI or USDA workflow, and what percent of them were affirmed in each time frame. |

| Institutional Confirms Affirmed by Institution in TradeSuite ID | Number of institutional confirms affirmed by the institution in TradeSuite ID, and what percent of them were affirmed in each time frame |

| Institutional Confirms Affirmed by Agent in TradeSuite ID | Number of institutional confirms affirmed by the agent in TradeSuite ID, and what percent of them were affirmed in each time frame |

Prime Broker Confirm Submission Breakdown

This section is only available if your Organization Type is Broker.

| Metric | Definition |

|---|---|

| Total Prime Broker Confirm Volume | Number of prime broker confirms submitted to TradeSuite ID, broken down by whether they were Affirmed, Unaffirmed, or Cancelled |

| Prime Broker Confirms Submitted by Broker Directly to TradeSuite ID | Number of prime broker confirms the broker submitted to TradeSuite ID, and what percent of them were submitted in each time frame |

| Prime Broker Confirms Submitted by CTM to TradeSuite ID | Number of prime broker confirms CTM submitted to TradeSuite ID, and what percent of them were submitted in each time frame |

Prime Broker Confirm Affirmation Breakdown

| Metric | Definition |

|---|---|

| Confirms Affirmed by Prime Broker in TradeSuite ID | Number and percentage of confirms the prime broker affirmed in TradeSuite ID, and what percent of them were affirmed in each time frame in TradeSuite ID. For Institution view, this metric will show Prime Broker confirms where their TradeSuite ID identifier was entered in the Interested Party field on the confirm. |

ITP Data Analytics captures all the trade record updates that happen on the trade regardless of when the trade record edit occurred and reflects the change in the data. This remains as the logic for CTM and TradeSuite ID trades and metrics in all reports other than the T+1 Scorecard.

A lookback period had been established for the T+1 Scorecard data records.

- For CTM Blocks and Allocations, trade records will only be updated if the record change was submitted within 120 days from the original submission date of the Block or Allocation. If an update is received on a trade originally submitted more than 120 days prior, the Block or Allocation record will not be updated.

- For TradeSuite ID Confirms, records will only be included on the T+1 Scorecard if the Settlement Date is within 50 days of Trade Date. Any Extended Settlement Trades with a settlement duration greater than T+49 will not be included. The T+1 Scorecard will continue to reflect the state of the confirm record as of Settlement Date.

For ALL TradeSuite ID confirms regardless of settlement cycle, the T+1 Scorecard calculates the affirmation metrics based on if the affirmation time happened on Trade Date. It will look at the Trade Date on the confirm and compare that to the timestamp when the affirmation happened. Based on how many hours the affirmation happened into and post trade date, that duration will determine the affirmation timing on T. Additionally, we only receive the confirm into our system on settlement date and we only look at the state of the confirm as it was on settlement date. Any updates happening AFTER settlement date will not be reflected in our system. For extended settlement trades, we will receive the details of that confirm on settlement date and then include that record in the respective weeks T+1 Scorecard based on Trade Date.

- Example 1 – Extended Settlement – Affirmation happened on Trade Date

- Trade date 2024-07-01

- Settlement date 2024-07-30

- Affirmation Timestamp 2024-07-01 11:45:00 ET

- This confirm will be considered “Affirmed by 9PM on T” as the affirmation happened before 9PM on Trade Date

- Example 2 – Extended Settlement – Affirmation happened day before settlement

- Trade date 2024-07-01

- Settlement date 2024-07-30

- Affirmation Timestamp 2024-07-01 11:45:00 ET

- This confirm will be considered “Affirmed After Trade Date” since the affirmation happened After Trade Date

- Example 3 – Extended Settlement – Affirmation happened AFTER settlement

- Trade date 2024-07-01

- Settlement date 2024-07-30

- Affirmation Timestamp 2024-07-01 11:45:00 ET

- This confirm will be considered “Unaffirmed” since the affirmation happened After Settlement Date

- The T+1 Scorecard only reflect the state of a confirm as of Settlement Date, if it is affirmed or cancelled after settlement we will not capture that change

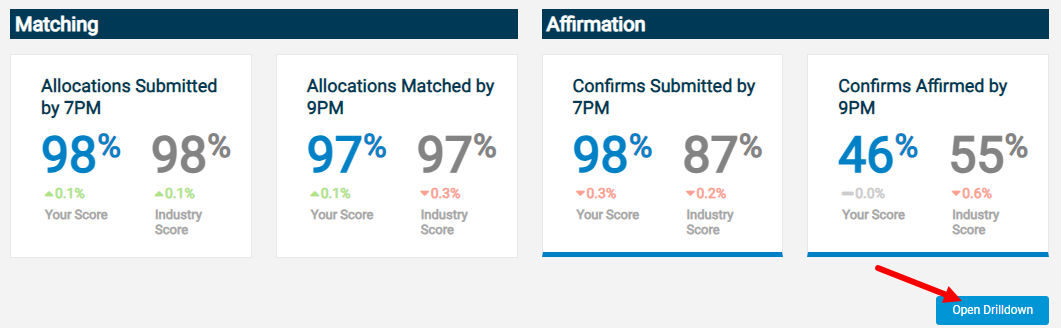

In additional to graphically, you can view the data on your T+1 Scorecard by counterparty.

Select Matching or Affirmation, and click Open Drilldown to open the drilldown section. Using filters and sorting in the section does not affect your other metrics represented by charts in the T+1 Scorecard.

See Export Results from ITP Data Analytics to learn how to export the data in the drilldown.

- Counterparty names and/or identifiers

-

Top Counterparties for Timing:

Matching: Use the drop-down list to display the data for allocations/confirms based on when they were matched.

Affirmation: Use the drop-down list to display the data for confirms based on when they were affirmed or if they are unaffirmed.

Ex: If you select Unaffirmed, the drilldown only shows your unaffirmed confirms per counterparty.

-

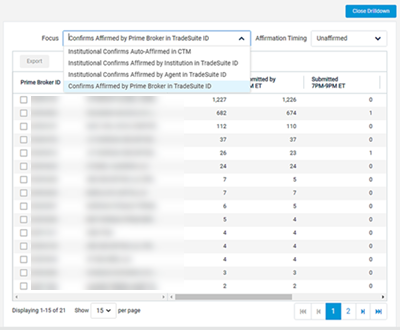

Use the Focus by drop-down list to display your counterparties.

Filter options are:

- Institutional Confirms Auto-Affirmed / Institutional Confirms Auto-Affirmed in CTM (IM / Broker view)

- Institutional Confirms Affirmed by Institution in TradeSuite ID

- Institutional Confirms Affirmed by Agent in TradeSuite ID

- Confirms Affirmed by Prime Broker in TradeSuite ID

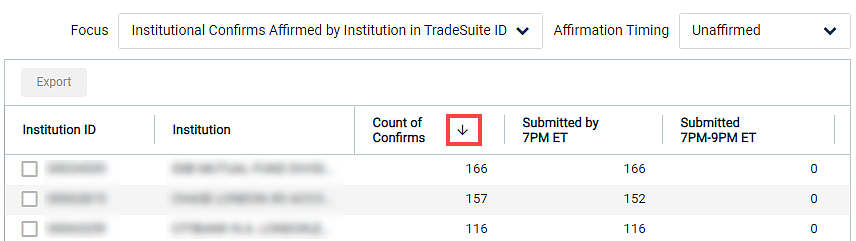

By default, the report sorts the data by the counterparties with highest Count of Allocations/Confirms in descending order for the selected timing.

If you sort the data by a different metric, the T+1 Scorecard displays an arrow next to the metric name.

To Sort by a Different Metric

- Click the column header of a metric once to sort the column in descending order, signified by the down arrow.

- Click again to sort the column in ascending order, signified by the up arrow.

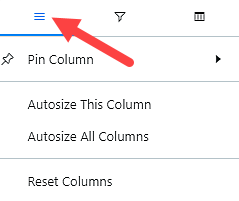

Put your cursor in a column header and click ![]() to access the following functionality:

to access the following functionality:

- Pin Column: Pin a column to one side when scrolling through the data grid. You can Pin Left or Pin Right. No Pin unpins the column.

- Size Columns: Adjust the size of a column in data grid. You can Autosize This Column, Autosize All Columns, or Reset Columns.

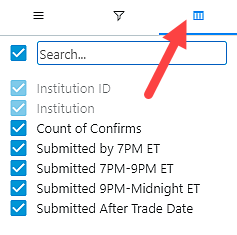

- Metric Filter: Filter which metrics appear. The default view shows all metrics available in the T+1 Scorecard.

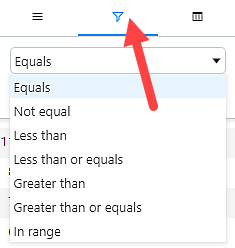

- Quantity Filter: Filter which counterparty confirms to view based on numeric operators. The default view shows all.

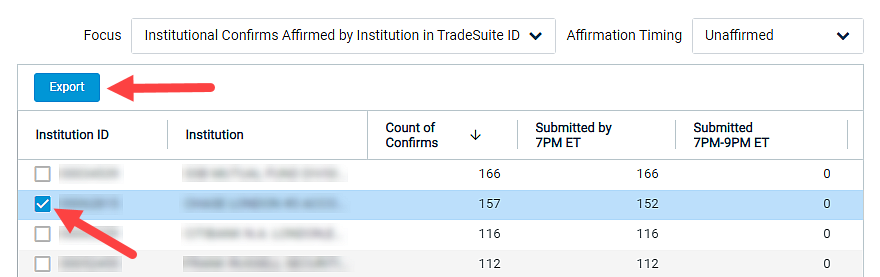

You can export a single counterparty's data. Subscribers to the TradeSuite ID® service can export underlying confirms for a counterparty, and subscribers to the CTM® service can export underlying transaction details for a counterparty.

ITP Data Analytics can only export up to 150,000 trades. If the Count of Confirms/Allocations for the selected counterparty exceeds 150,000, ITP Data Analytics produces an error message.

To learn how to export all counterparties in the drilldown, see Export Results from ITP Data Analytics.

Select a counterparty and click Export to export the results of a single counterparty.