Market Best Practices for Portugal: Interbolsa and PEXsettle

This topic provides best practices for populating and interpreting settlement instructions for in Portugal when using Interbolsa and PEXsettle.

| Notes |

|

Broker/Dealers

Use the Market Best Practices for Broker/Dealers to view the latest applicable country/security/method (CSM) combinations and best practices.

Investment Managers

For instructions settling under Interbolsa:

- Country: PORTUGAL - PT

- Method: CAMBIUM - Interbolsa

- Security (one of the following):

- EQU - Equities

- COB - Corporate Bonds (for any corporate fixed income)

- TRY - Treasuries (for any government fixed income)

- MSC - Miscellaneous

When you use these combinations, ALERT automatically populates the PSET field with the BIC of the associated depository in Portugal.

For instructions settling under PEXsettle:

- Country: Portugal - PT

- Method: PEXSETTLE - PEXsettle

- Security (one of the following):

- EQU - Equities

- COB - Corporate Bonds (for any corporate fixed income)

- TRY - Treasuries (for any government fixed income)

- MSC - Miscellaneous

When you use these combinations, ALERT automatically populates the PSET field with the BIC of the associated depository in Portugal.

| Note |

| For GC Direct Account maintenance, DTCC recommends maintaining a minimum of three basic security types for each market: Equity (EQU); Fixed Income (COB); and Government Bonds (TRY). To enable faster onboarding, you can align with your custodian on security types in preparation for GC Direct onboarding. Check with you custodian if other security types, such as Money Market (MMT), are supported. |

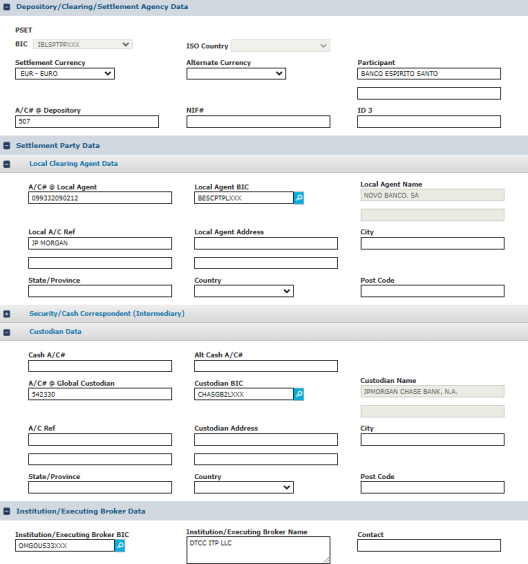

The next table lists the fields for settling in Portugal whether the depository is Interbolsa or PEXsettle.

| Field | Requirement | Definition |

|---|---|---|

| Depository/Clearing/Settlement Agency Data | ||

| PSET BIC |

Mandatory |

BIC of Interbolsa or PEXsettle. |

| A/C# @ Depository (ID1) |

Recommended |

Membership number in either Interbolsa or PEXsettle. |

| NIF# (ID2) |

Recommended |

Numero de Identificacao Fiscal or tax identification number in Portugal. |

| Settlement Party Data: Local Clearing Agent Data | ||

| A/C# @ Local Agent |

Mandatory |

Account number of the global custodian at the local agent. |

| Local Agent BIC |

Mandatory |

BIC of the global custodian or local agent who has membership at Interbolsa/PEXsettle. |

| Settlement Party Data: Security/Cash Correspondent (Intermediary) | ||

| Correspondent Security A/C# |

Recommended |

Account number of the global custodian at the intermediary. |

| Relationship |

Recommended |

In ALERT, select Local Agent when setting up three levels of clearing. |

| Correspondent BIC |

Recommended |

BIC of the intermediary. |

| Settlement Party Data: Custodian Data | ||

| A/C# @ Global Custodian1 |

Recommended/mandatory for settlement notification in CTM |

Account number of the fund at the global custodian. |

| Custodian BIC2 |

Recommended |

BIC of the global custodian. |

| Institution/Executing Broker Data | ||

| Institution/Executing Broker BIC | Recommended/mandatory for settlement in T2S markets | BIC of the instructing party. |

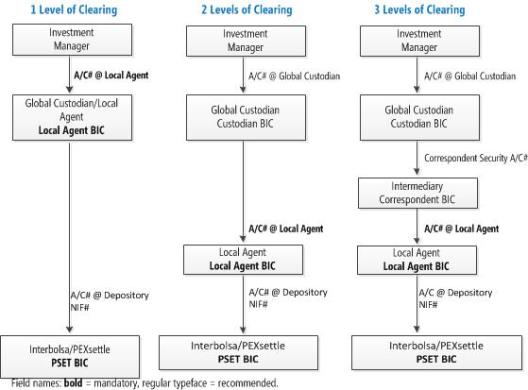

The next figure shows an example of an investment manager's (investment managers and those acting OBO an investment manager (global custodians, regional custodians, and trustees)) instruction on ALERT's web interface when settling in Interbolsa.

|