ALERT: Securities and Security Type Groups

To simplify the tables in this guide, securities are categorized into the security type groups listed in this section, as suggested by the Securities Market Practice Group (SMPG).

| Notes |

|

| EQU (Equities) |

Corp FI (Corporate Fixed Income) | GovtFI (Government Fixed Income) |

MM (Money Market) |

FX/CSH (Foreign Exchange/CASH) |

Deriv (Derivatives) |

Unsp(Unspecified) |

|---|---|---|---|---|---|---|

| EQU | COB | TRY | MMT | Not Applicable | Not Applicable | COB |

| ADR (American Depository Receipt) | ABS (Asset Backed) | AGS (Agencies) | BAS (Bankers Acceptance) | CSH (Cash) | CDS (Credit Default Swap) | OPC (Options Contract) |

| EQU (Equities) | BKL (Bank Loan) | FNM (Fannie Mae) | CER (Representative Certificate) | F/X (Foreign Exchange) | CFD (Contract for Difference) | PRC (Premium Contract) |

| ETF (Exchange Traded Fund) | CMO (Collateralized Mortgage Obligation) | FRM (Freddie Mac) | COD (Certificate of Deposit) | MRG (Margin) | CMF (Commodity Future) | PRP (Private Placement) |

| GDR (Global Depository Receipt) | COB (Corp Bond) | GNM (Ginnie Mae) | COM (Comm Paper) | TIM (Time Deposit) | EFU (Exchange Traded Futures) | REP (Repurchase) |

| PRS (Premium Shares) | CON (Convertible Bond) | ITS (Indexed Treasury Security) | FIN (Finance Transaction) | ETD (Exchange Traded Derivatives) | TRS (Trans Ship) | |

| RTS (Rights) | ETO (Exchange Traded Options) | |||||

| UIT (Unit Investment Trust) | CPN (Coupons) | MNB (Muni Bond) | MMT (Money Market) | FXF (FX Future) | WAR (Warrants) | |

| FPA (Face or Principal or Nominal Amt) | NSD (Non-US Sovereign Debt) | REP (Repurchase) | FXS (FX Swap) | |||

| ILB (Inflation Linked Bonds) | TRY (Treasuries) | IRF (Interest Rate Future) | ||||

| MBS (Mortgage Backed) | T-Bills (TBI) - applies to all countries except the United States | IRS (Interest Rate Swap) | ||||

| NTE (Notes) | OTC (OTC Derivatives) | |||||

| SLA (Student Loan) | TBA (To Be Announced) | |||||

| TBA(To Be Announced) |

TRW (Total Return Swap) |

|||||

|

|

Alternate Security Types

The next table lists alternative security types available on the ALERT® service. These security types support complex markets where there is more than one instruction per account, security, and method combination.

Alternative Security Types Specific to Hong Kong and China Country Codes

- EQU = EQA

- COB = CBA

- TRY = TRA

- MMT = MMA

Additional F/X Security Types

Four alternative foreign exchange (FX1-FX4) security types are available for the following markets only:

|

|

| EQUALL | Corp FI | Govt FI | MM | FX/CSH | DERIV | UNSP |

|---|---|---|---|---|---|---|

| EQA (Equities - Alternative) | CBA (Corp Bond - Alternative) | TRA (Treasuries - Alternative) | MMA (Money Market - Alternative) | FX1 (Foreign Exchange - Alternative) | - | - |

| FX2 (Foreign Exchange - Alternative) | ||||||

| FX3 (Foreign Exchange - Alternative) | ||||||

| FX4 (Foreign Exchange - Alternative) |

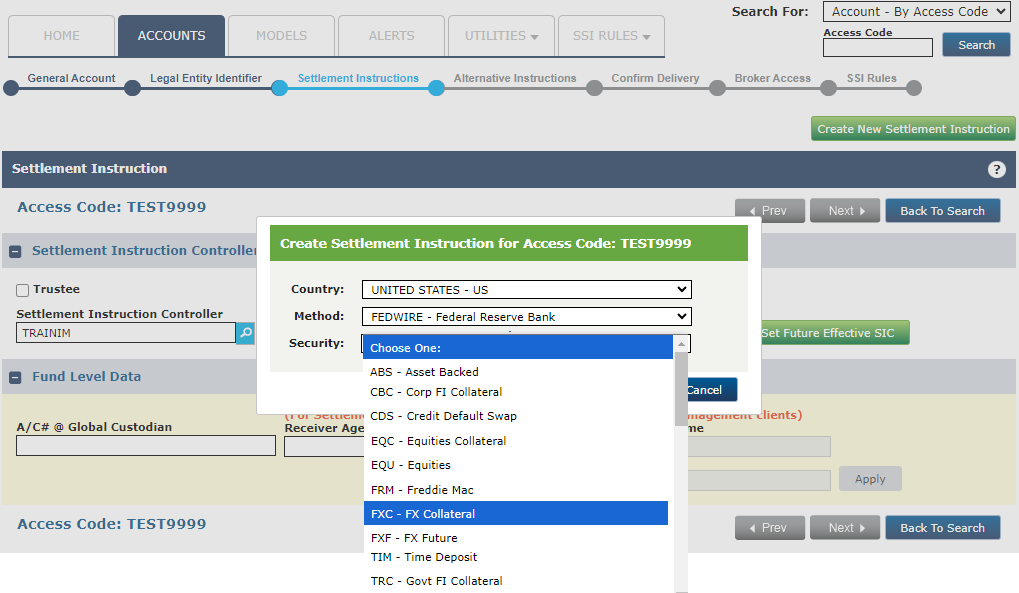

Collateral Specific Security Types

To provide the ability for the clients to maintain and communicate Collateral SSIs to their counterparties, there are the following collateral security types:

- FXC to support FX and Cash SSI Structure

- EQC to support Equites Structure

- CBC to support Corp FI Structure

- TRC to support Govt FI Structure

These security types (FXC, EQC, CBC, TRC) are available in the standard security drop-down within the Settlement Instructions tab.

|

| Note |

| Broker Direct clients will need to include these four security types in their automated interface to consume collateral alerts and SSIs. |