ALERT: Market Best Practices for the United States: Fedwire

This topic describes best practices for populating standing settlement instruction fields for Fedwire on ALERT. These recommendations are relevant for all ALERT releases. By adhering to these recommendations, you facilitate successful settlement messages through SWIFT or other means.

| Note |

|

Click the icons to expand, collapse, and print the content on this page.

Investment Managers

Use the Market Best Practices for Investment Managers to view the latest applicable country/security/method (CSM) combinations and best practices.

To create an SSI on ALERT for this market, use the following recommended ALERT country/method/security combinations:

- Country: United States

- Method: FEDWIRE

- Security: (one of the following):

- MMT: Money Market

- TRY - Treasuries (for any government fixed income)

- MBS - Mortgage Backed Securities

| Important |

| Do not use the Fedwire method for the TBA security type in when the settlement of Pair Offs is a CASH movement and your instruction differs from your US-F/X-CASH instruction. Instead, use the US-TBA-CASH combination. This separate TBA cash instruction is only necessary if your instruction differs from your F/X instructions. Where settlement of Pair Offs results in securities movement, use your standard MBS-FEDWIRE instruction. |

Use of this country/method/security combination enables the associated field labels and validation rules specific to the US FED market within ALERT. When you use this combination, ALERT automatically populates the PSET field with the BIC of Fedwire.

| Note |

| For GC Direct Account maintenance, DTCC recommends maintaining a minimum of three basic security types for each market: Equity (EQU); Fixed Income (COB); and Government Bonds (TRY). To enable faster onboarding, you can align with your custodian on security types in preparation for GC Direct onboarding. Check with you custodian if other security types, such as Money Market (MMT), are supported. |

The next table describes the settlement fields.

| Field Name | Definition | Example | Mapped to SWIFT TAg |

|---|---|---|---|

| Depository/Clearing/Settlement Agency Data | |||

| PSET BIC | Place of Settlement. ALERT automatically populates this field as FRNYUS33 when you select FEDWIRE as the method of settlement. | FRNYUS33 | Yes |

| Participant | Optional: Name associated with the ABA number of local agent | JP MORGAN CHASE NEW YORK | No |

| ABA # (ID1) | Mandatory: ABA (American Bankers Association) number (9 digits) of local agent at Fedwire | 021000021 | Yes |

| Fed A/C (ID2) |

Mandatory: Fedwire account mnemonic of local agent with membership at Fedwire. The format is either numeric or alphabetic (CAPITAL letters). For example, 1050 or CUST. Note that the name of the clearing bank and the forward slash (/) should not be present. For example, if the value you have been provided states BANKOFNY/CUST, do not enter the BANKOFNY/ value in this field, only CUST. You can optionally populate BANKOFNY in the Participant field. Note: If you have SSIs that mention an FFC (For Further Credit) or Receiving Third Party account, also populate its value here, separating the numbers with a forward slash (/). For example, CUST/125897. In addition, duplicate your FFC or Receiving Third Party value in the A/C Ref field. |

Without an FFC Account: CUST With an FFC Account: CUST/125897 |

Yes |

| GSD # (ID3) | Optional. Government Securities Division number (4-character alphanumeric). | No | |

| Agent ID |

Optional: DTC number (8 digits) of the agent. This field is mandatory for the Match to Instruct workflow. If left blank, CTM will not be able to create an ID Confirm in TradeSuite. |

00000902 | No |

| Inst/Broker ID |

Optional: DTC number (8 digits) of the investment manager. This field is mandatory for the Match to Instruct workflow. If left blank, CTM will not be able to create an ID Confirm in TradeSuite. |

00000100 | No |

| Settlement Party Data: Local Clearing Agent Data | |||

| A/C# @ Local Agent |

|

||

| Local Agent BIC | BIC identifying the global custodian or local agent who has membership at Fedwire. | CHASUS33XXX | Yes |

| Settlement Party Data: Security/Cash Correspondent (Intermediary) | |||

| Correspondent BIC | For three levels of clearing only: BIC of the intermediary | Yes | |

| Correspondent Security A/C# | For three levels of clearing only: Account number of the global custodian at the intermediary | ` | Yes |

| Relationship | Select SUBAGENT when setting up three levels of clearing. | Yes | |

| Settlement Party Data: Custodian Data | |||

| A/C# @ Global Custodian | Fund or safekeeping account at the global custodian |

967-01 1198199 |

Yes |

| A/C Ref |

For Further Credit (FFC) account number, or a Receiving Third Party account number. For example, 125987. Populate this field only if your SSIs mention this account. Note: Also dual-populate the FFC account number or Receiving Third Party account number in the Fed A/C field in the Local Depository/Clearing/Settlement Agency Data section. Prefix it with the Fed A/C mnemonic and a forward slash (/). |

125897 | No |

| Custodian BIC | For two of three levels of clearing, BIC of the global custodian. | ||

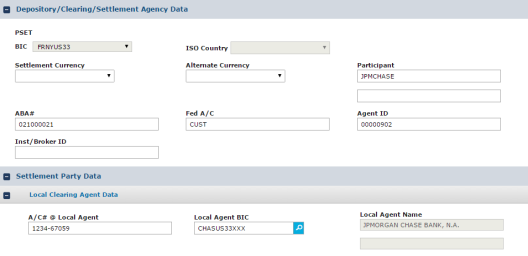

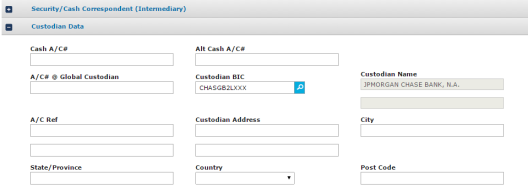

U.S. Domestic, One Level of Clearing for Fedwire

When the global custodian is based in the United States, clearing at Fedwire is usually carried out directly, without a local agent or an intermediary. The custodian has an ABA routing number and a Fedwire account. As this is a scenario of one level of clearing, enter the custodian’s BIC data in the Settlement Party Data: Local Clearing Agent Data group. Enter the safekeeping account for your fund in the Custodian Data section—A/C at Global Custodian field.

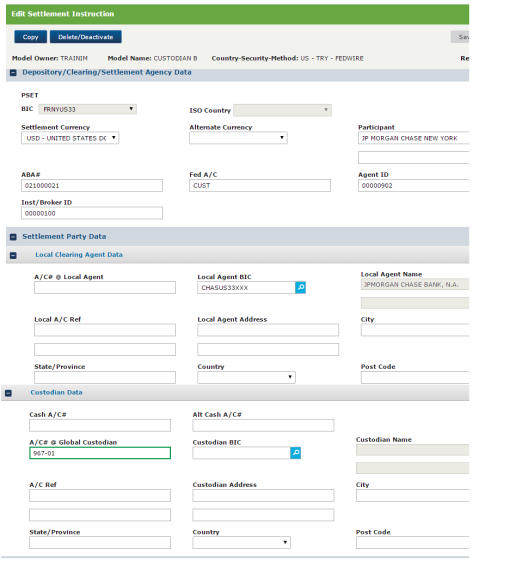

The next figure shows an example of an investment manager’s settlement instructions for one level of clearing, without a For Further Credit (FFC) / Third Party Receiving Account.

|

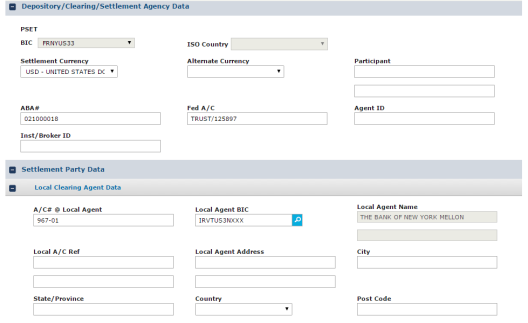

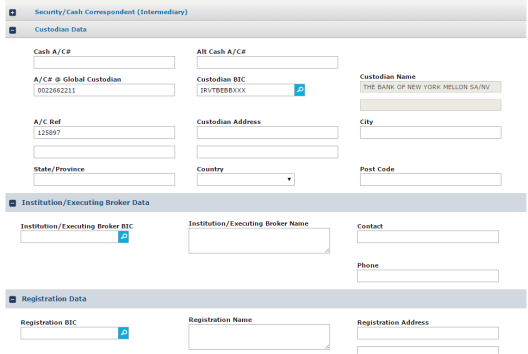

Cross-Border, Two Levels of Clearing

A scenario in which your global custodian uses another subcustodian or local agent to settle at Fedwire is a one with two levels of clearing. This scenario is often the case for cross-border settlement. DTCC recommends that both entities are represented using their BIC code, thereby allowing international users of ALERT to quickly identify the parties involved in settlement.

The next figure shows an example of an investment manager’s settlement instructions for Fedwire with two levels of clearing.

|

|

Two Levels of Clearing With an FFC Account

The next figure shows an example of an investment manager’s settlement instructions for Fedwire with two levels of clearing. In addition, in this example, the investment manager also has SSIs with For Further Credit (FFC) / Third Party Receiving Accounts.

|

|